Are you ready to unravel the complexities of New York State taxes? Navigating the tax landscape of the Empire State can seem daunting, but understanding your obligations is crucial for financial well-being.

The New York State Department of Taxation and Finance offers a comprehensive online portal, accessible anytime, anywhere. Whether you need to check your refund status, access tax forms, or understand your tax responsibilities, the official website is your go-to resource.

Here's what you need to know to stay informed and compliant:

Key Resources and Services:

- Official Website: The cornerstone of your tax journey. Visit the official website of the NYS Department of Taxation and Finance to begin.

- Tax Forms and Instructions: Find current and past year forms and instructions for various tax types, including income tax, sales tax, and property tax. Many are now available as webpages for easier access and understanding.

- Refund Status: Enter your requested refund amount and Social Security number to check the status of your New York State income tax refund.

- Online Services: Manage your tax information securely through your individual online services account. Pay bills, file for extensions, respond to notices, and sign up for refund notifications.

- Tax Calculators: Utilize online tools to calculate your New York income tax, taking into account filing status, location, and income.

- Payment Options: Learn how to pay your personal or corporate income tax, estimated tax, or resolve an audit case online or through other methods.

Heres a breakdown of information relevant to the topic, presented in a table format:

| Category | Details |

|---|---|

| Tax Types |

|

| Key Considerations |

|

| Tax Rates and Brackets |

|

| Tax Benefits and Programs |

|

| Resources and Tools |

|

| Filing Tips |

|

| Additional Information |

|

Deeper Dive into Key Topics:

Income Tax Basics:

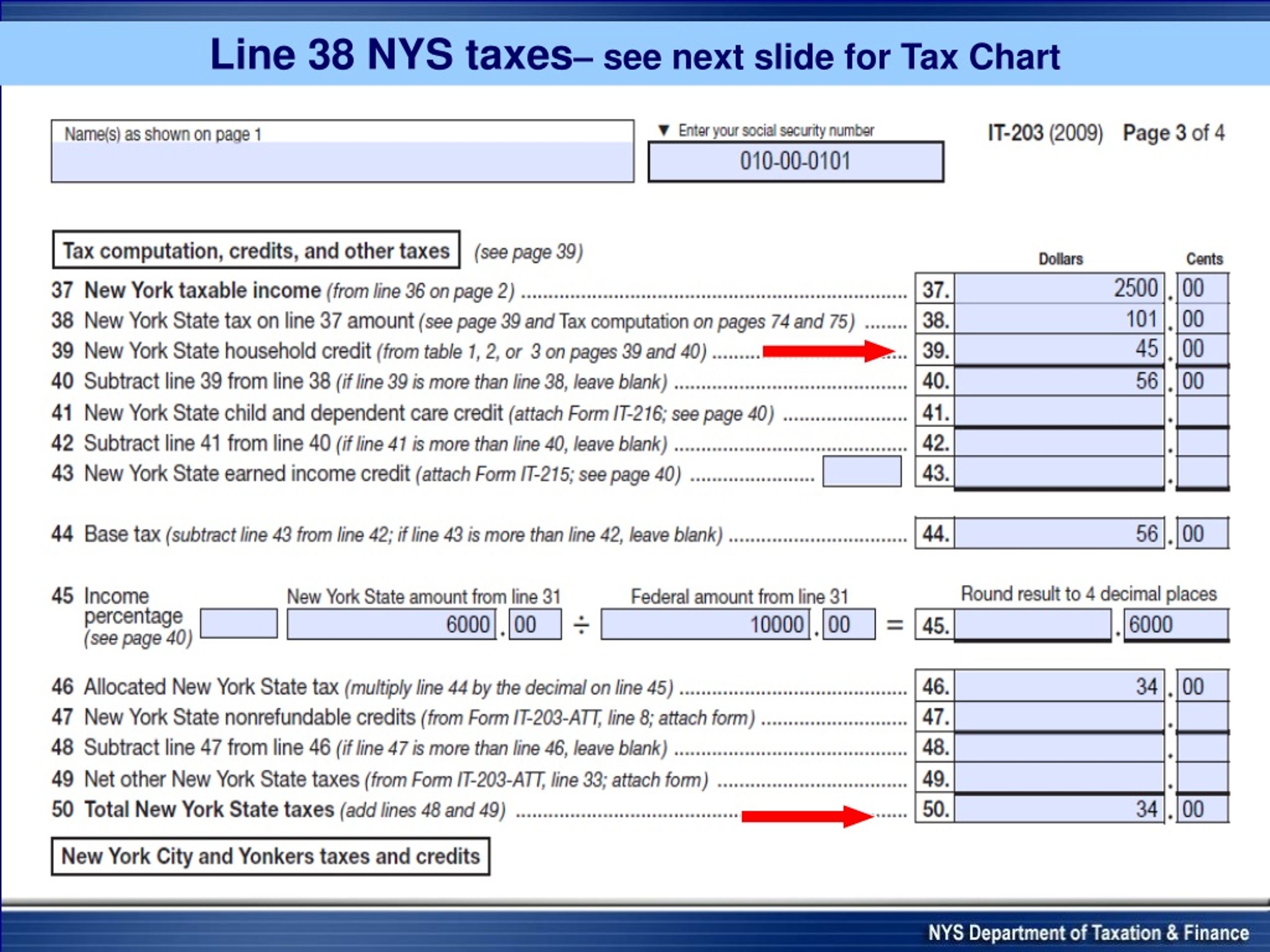

New York State's income tax is structured with a progressive system. This means that higher income levels are subject to higher tax rates. Understanding the tax brackets and how they apply to your income is crucial for accurate tax planning.

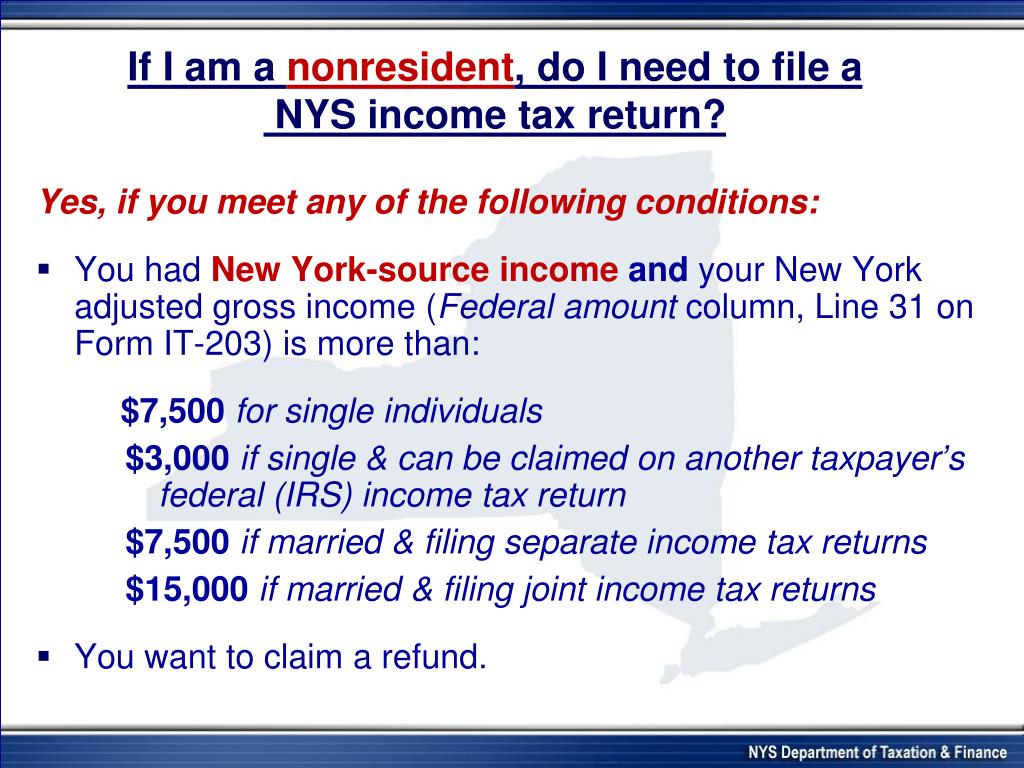

Residency and Filing Status:

Your residency status (resident, part-year resident, or non-resident) determines how your income is taxed in New York. The filing status you choose (single, married filing jointly, head of household, etc.) also influences your tax liability. Be sure to select the status that most accurately reflects your situation to ensure you receive all applicable benefits.

Tax Rates and Brackets for 2024 (Reported in 2025):

New York's income tax system features nine marginal tax brackets. The tax rates range from 4% to 10.9%. Remember that each tax rate applies only to the portion of your income that falls within that specific bracket. The tax brackets are regularly updated, so staying informed about the latest rates is essential.

Credits, Deductions, and Exemptions:

New York offers various credits, deductions, and exemptions that can reduce your taxable income and overall tax liability. Explore these options to see if you qualify. Common deductions include the standard deduction (amount varies based on your filing status) and itemized deductions. Credits can directly reduce the amount of tax you owe.

Filing Methods and Tips:

You can file your New York State taxes electronically or by mail. Electronic filing is generally the fastest and most secure method. Consider using tax preparation software or consulting with a tax professional if you have complex tax situations.

Understanding Your Refund Status:

Use the online refund status tool to check the status of your state income tax refund. Have your requested refund amount and Social Security number ready. The website provides information on how to understand the refund status message, respond to requests for information, and troubleshoot any potential issues.

Payment Options and Debt Resolution:

Learn about the various methods available to pay your taxes, including direct payment from your bank account. If you encounter difficulties meeting your tax obligations, explore debt resolution resources and payment options offered by the Department of Taxation and Finance.

Resources for Businesses:

The Department provides resources for businesses, including information on corporate income tax, sales tax, and employer responsibilities. If you operate a business in New York, familiarize yourself with the specific tax requirements relevant to your entity type.

Key Considerations for Rent Collections:

Pay close attention to any changes affecting the collection of rent. Such changes are specifically applicable on and after the date specified by the Department. Stay up-to-date by reviewing official publications and announcements.

Avoiding Delays and Ensuring Accuracy:

To avoid delays in processing, respond promptly to any requests for documentation from the Department. Use the "Respond to Department Bill or Notice" service to upload the requested information. If a fax number is provided in correspondence, on a form, or in instructions, use only that number.

Security and Privacy:

Always share sensitive information on secure websites, indicated by "ny.gov" in the web address. This ensures your data is protected and confidential. Be wary of phishing attempts and scams.

Important Notes:

- Tax Year 2024: Be aware of the latest updates, credits, and tips for the 2024 tax season (reported in 2025).

- Tax Rates: Keep abreast of New York's income tax rates, brackets, deductions, and filing tips for the 2024 tax year.

- Tax Calculator: The New York tax calculator is updated regularly to reflect current tax laws.

- Tax Table Availability: Income tax tables are readily available and are crucial for understanding your tax liability.

By taking the time to understand the intricacies of New York State income tax, you can navigate the system more effectively, ensure compliance, and potentially maximize your refund.

The Department of Taxation and Finance website is your primary resource for tax-related information and services, offering convenience and accessibility, anytime, anywhere.