Are you a household employer struggling with the complexities of nanny taxes and payroll? Navigating the intricate world of tax obligations for your household staff doesn't have to be a source of stress or a drain on your resources.

Poppins Payroll steps in as a simple, affordable, and reliable solution for managing taxes and payroll for nannies, housekeepers, senior caregivers, and other household employees. It's a service designed to alleviate the burden of legal and financial compliance, allowing you to focus on what truly matters: your family and your peace of mind. The platform is a comprehensive solution, designed with simplicity in mind. Poppins Payroll handles the intricacies of payroll, tax calculations, and filings, making it easier than ever to manage your household employment responsibilities.

The benefits extend beyond mere convenience. By using Poppins Payroll, employers ensure they are compliant with all federal and state tax obligations. This includes calculating and withholding the correct amount of taxes, making timely payments to the appropriate agencies, and providing employees with accurate pay stubs. This adherence to legal requirements protects the employer from potential penalties and liabilities.

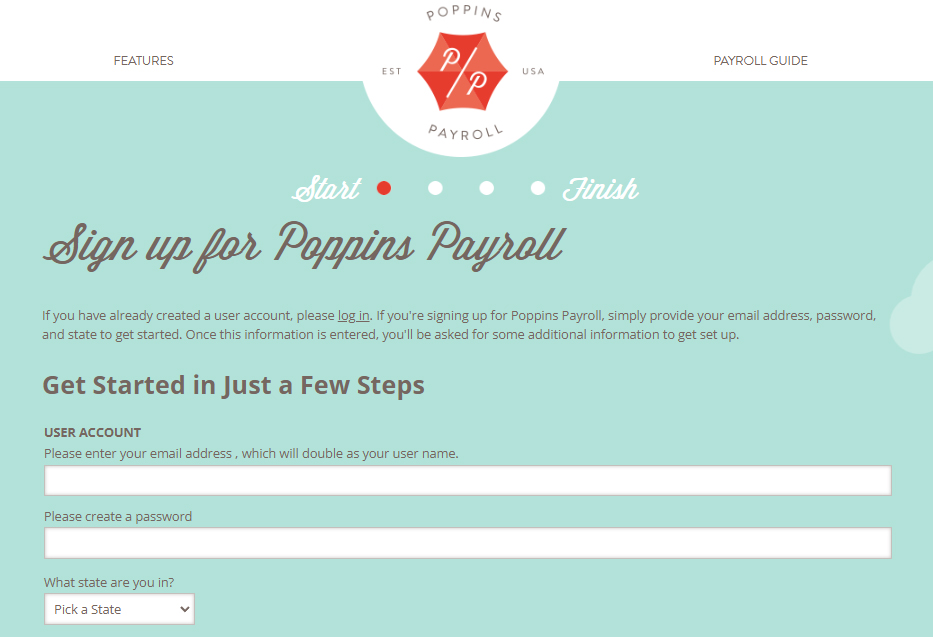

Poppins Payroll offers a streamlined experience. Sign-up is designed to be straightforward, requiring you to enter employer and employee information just once. From there, the system takes over, automating calculations, facilitating direct deposits, and ensuring electronic filing. For a flat monthly fee of $49, Poppins Payroll manages all aspects of nanny and household payroll and taxes, providing a comprehensive service that simplifies the process and saves you valuable time and effort.

Let's delve deeper into the features, pricing, and benefits of Poppins Payroll, and explore how it can transform the way you manage your household employment. The platform offers many features, designed to make your experience as easy and efficient as possible. Automatic calculations, direct deposit, electronic filing and more, this platform is designed to simplify the often complex task of paying household employees.

Nanny taxes, often a daunting subject for families, are clearly defined as the federal and state tax obligations associated with hiring a household employee, such as a nanny or caregiver. The platform offers a comprehensive solution for navigating these complexities. With Poppins Payroll, you can pay your household employee the right way, adhering to all tax regulations, including social security, medicare, and unemployment taxes.

| Feature | Description |

|---|---|

| Payroll Processing | Handles salary, deduction, and tax calculations, ensuring accurate and timely payments. |

| Tax Management | Manages all aspects of payroll taxes, including federal and state tax filings, registrations, and submissions. |

| Direct Deposit | Enables direct deposit to employee accounts, providing convenience and efficiency. |

| Electronic Filing | Facilitates electronic filing of tax forms, streamlining the compliance process. |

| Pay Stub Generation | Generates and provides pay stubs directly to your employees, ensuring transparency. |

| Employer Registration | Assists with employer registration, including obtaining tax IDs and setting up state, federal, and local accounts. |

| PTO Tracking | Provides PTO (Paid Time Off) tracking. |

| Bookkeeping Support | Keeps track of your bookkeeping online. |

With Poppins Payroll, flexibility is paramount. You can manage payroll, view tax filings and payments, and update your account details conveniently through a secure login. This easy and accessible interface, combined with the expert support, ensures that your payroll tasks are handled with precision and ease. With ultimate flexibility, guidance, and support at your fingertips, managing your household employment becomes a more manageable and less stressful task.

For those on a budget, Poppins Payroll is a great option. It offers a full range of servicesfrom payroll to taxesat one low price of $49 per month. This simplicity of pricing, combined with the comprehensive service, makes it a compelling choice. The platform's user interface is also notable. Colorful and enjoyable to interact with, it lists out its services and fees with complete transparency, building trust and confidence in the user experience.

Poppins Payroll prides itself on its reliability and ease of use. The platform takes care of everything, from setting up your Federal Employer Identification Number (EIN) to keeping track of all tax deadlines and rules. The guarantee is that your taxes are always paid to the correct agencies on time and with total accuracy.

The platform also handles salary, deduction, and tax calculations, payments, and filings, as well as employer registration and PTO tracking. Platforms like Poppins Payroll handle the calculations for tax withholdings and create required documentation like pay stubs, letting you focus on what matters most your family. This streamlined approach significantly reduces the administrative burden on household employers.

The service is designed to be easy to use, even for those without prior experience in payroll management. With a simple sign-up process, you enter your employer and employee information once. The system then handles all the necessary calculations, payments, and filings. You can also set your own sick leave and manage other aspects of your employee's compensation, ensuring that the payroll process aligns with your specific needs and preferences. The platform provides a solution that integrates payroll and taxes seamlessly, designed to be used by those who employ nannies, housekeepers, senior caregivers, and other household staff.

One of the significant advantages of using Poppins Payroll is that you don't have to empty your wallet to run a perfect payroll. The platforms affordable pricing, coupled with its comprehensive services, makes it accessible to a wide range of household employers. The combination of affordability, ease of use, and comprehensive features makes Poppins Payroll a compelling choice for those seeking to simplify their household employment responsibilities. The platform is dedicated 100% to household payroll services, so you know they are done right. It ensures that taxes are paid on time, and the correct agencies are paid. This focus allows it to deliver a high level of expertise and attention to detail in a niche area of financial management.

The process is designed to be straightforward. You simply sign up for the nanny tax payroll services, enter your information as the employer and your employee's details, and the platform will handle everything. The platform gets your tax IDs, registers your new hires, sets up your state, federal, and local accounts, calculates all the withholdings, and keeps track of your bookkeeping online, saving you time and stress. The platform offers an easy and affordable way to manage payroll for nannies, senior caregivers, housekeepers, and other household staff, handles all nanny payroll and tax processes from depositing payments to employee accounts and remitting payroll taxes to electronically filing tax forms for you.

Poppins Payroll's mission is clear: to make managing nanny taxes a merry experience. By offering an easy and affordable solution, they aim to simplify the process and provide peace of mind to household employers. It ensures that the employer is compliant, avoids potential penalties, and allows you to confidently fulfill your obligations.

While other services may calculate taxes and guide you on what forms to fill out, it's still up to you to file and pay them. With Poppins Payroll, they handle everything, relieving you of the administrative burden. The platform ensures that all tax obligations are met and that employees are paid accurately and on time.