Are you a tax professional seeking to optimize your practice and empower your clients? Drake Software offers comprehensive solutions, backed by cutting-edge technology and unwavering support, to streamline your workflow and elevate your service delivery.

In the dynamic realm of tax preparation, the right software can make all the difference. Drake Tax emerges as a leading contender, offering a robust suite of features designed to meet the diverse needs of tax professionals. Whether you operate as a solo practitioner or lead a multi-user firm, Drake Software provides versatile solutions to cater to your specific requirements. From desktop and cloud-based options to online platforms, Drake ensures accessibility and adaptability for your practice.

To delve deeper, here's a comparative table outlining the key features and benefits of Drake Tax, alongside a reference to their official website for comprehensive information:

| Feature | Description | Benefit |

|---|---|---|

| Multiple Solutions | Offers desktop, cloud, and online solutions. | Provides flexibility and choice based on practice needs. |

| Single User Versions | Drake Tax Pro and Drake Tax 1040 are available for single-user businesses. | Caters to solo tax preparers or businesses with a limited number of preparers. |

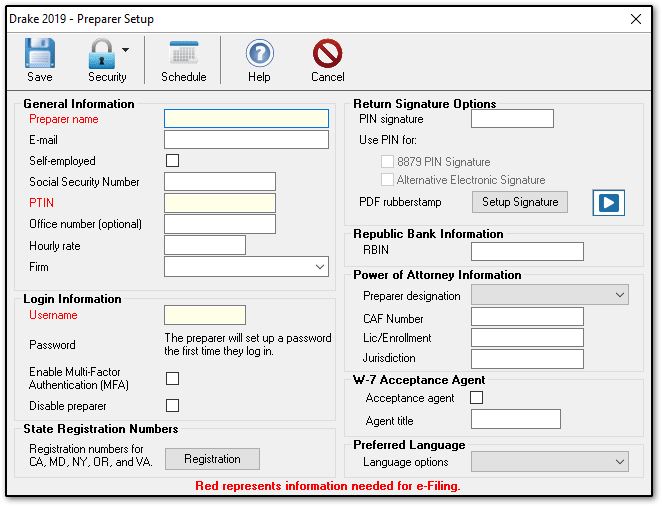

| User Definition | Defines a user as anyone with a PTIN who prepares or substantially aids in preparing tax returns. | Ensures accurate user count and licensing compliance. |

| Download and Installation | Facilitates easy downloading and installation of Drake Tax programs. | Simplifies the software acquisition and setup process. |

| Tax Year and State Selection | Allows users to choose the appropriate tax year and states. | Enables accurate and relevant tax preparation. |

| Quick Start Tutorial | Provides a quick start tutorial to get you started. | Offers an accessible way for users to start using the platform. |

| New Features Updates | Updates to new features. | Helps the user to stay updated on latest features. |

| Workflow and Efficiency | Designed to streamline your workflow and enhance your efficiency. | Helps users save time. |

| Client Focus | Enables you to focus on serving clients and growing your practice. | Allow users to give more importance to their clients. |

| Trial and Pricing | Try it free with pricing options. | Helps user to see if it fits their need. |

| Customer Recommendation | Drake Tax received high ratings for user recommendation | Provides assurance to the new users |

| Comprehensive Support | Offers tools and support tax professionals need to build their businesses. | Gives the users a better opportunity to grow their business. |

| Electronic Filing | Helps you convert data from your current software, file electronically. | Allows for easy and convenient filing. |

| Practice Management | Maximizes your practice management processes. | Streamline the practice management process. |

| Customizable Software | Designed to help you provide the best service for your customers. | Allows users to provide the best service for their clients. |

| Instructional Videos | Learn the basics of drake tax with short instructional videos. | Helps the users to get started with the basics. |

| Tax Planner | Drake tax planner helps assist clients in planning for the future. | Helps users assist their clients to plan for future. |

For more in-depth information, visit the official Drake Software website: https://www.drakesoftware.com/

Drake Tax offers a multifaceted approach to tax preparation, addressing various aspects of the process. Single-user versions, specifically Drake Tax Pro and Drake Tax 1040, are meticulously designed for businesses with a single tax return preparer holding a PTIN. It's crucial to recognize that anyone with a PTIN actively involved in preparing or substantially assisting in the preparation of tax returns is classified as a tax preparer and, consequently, counted as a user.

The single-user version is expressly limited to one user, ensuring compliance and streamlining operations for smaller practices. To embark on your Drake Tax journey, the download and installation process for federal and state programs is readily accessible through the Drake download center. Here, you'll find clear instructions on how to enter your account and serial number, select the relevant tax year and states, and review the system requirements and what's new in the software.

The software caters to various needs, including special tax treatment for small limited liability companies (SMLC). For those seeking to get started with Drake Tax, a quick start tutorial provides step-by-step directions to guide you through the initial setup. The platform also features a series of instructional videos, encompassing topics such as setting up Drake on a standalone computer or office network, what's new in Drake Tax, and how to use Drake Tax, which is a tax preparation software tailored for accountants and tax professionals.

Drake Software allows a tax professional to prepare tax returns for individuals, businesses, and for both federal and state jurisdictions. The software is engineered to streamline workflows and boost efficiency. Featuring an array of powerful tools, it empowers you to focus on client service and the growth of your practice. Moreover, you can explore the software's capabilities by trying it free, with pricing options readily available.

With a legacy of 48 years of reliability and performance, Drake Tax has established a solid reputation in the industry. Ratings reflect this, with Drake Tax consistently achieving high scores. Furthermore, when asked about recommending the software to someone starting a tax practice, Drake Tax garners significant affirmation from its user base, with a substantial percentage expressing a positive recommendation. This underscores Drake's capacity to provide the resources and support needed by tax professionals to cultivate their businesses and attract new clientele.

The software offers a wealth of features designed to aid tax professionals in navigating the filing process efficiently. These features, detailed further below, are constantly updated to meet the evolving needs of the tax landscape. For instance, Drake Tax online provides full tax compliance, akin to Drake Zero and Web1040, with the added capability to file business tax returns. Furthermore, Drake Tax Online offers the flexibility to seamlessly switch between online and desktop data entry modes.

To renew your software online, the process is straightforward. Users can use a credit or debit card by logging in to the Drake Software support website and navigating to the account renewals section. Further, to enhance user experience, new online help features are integrated within Drake Tax, directing users to program help information and knowledge base articles. This is supplemented by integration with Drake Portals to import client data, reducing the need for manual data entry.

The Drake Tax trial offers a valuable opportunity to assess the ease and functionality of the program on your own computer. In trial mode, users can test functionality and even convert data from other programs, with most functions available for evaluation. It is important to note that the trial program does not require a serial number to run.

Drake Tax also facilitates data conversion from your current software, offers electronic filing capabilities, and helps maximize your practice management processes. The customizable tax software is designed to help you provide the best service for your customers. For those who prefer a more structured learning environment, classroom training and live webcasts are also available to provide comprehensive knowledge about Drake Software products. The Drake Tax Planner is a particularly valuable tool, designed to assist clients in planning for the future by comparing their current tax situation to various scenarios such as marriage, the birth of a child, buying or selling a house, or changes in income.

In summary, Drake Tax is a comprehensive solution designed for tax professionals, providing the tools, support, and features needed to thrive in today's dynamic tax landscape. From streamlined workflows to client-centric tools, Drake empowers users to build their businesses, serve their clients effectively, and remain at the forefront of the industry.