Are you navigating the complex landscape of California taxes, feeling lost in a sea of forms and deadlines? The California Franchise Tax Board (FTB) is the key to unlocking a smoother, more informed tax experience, providing essential services and resources for taxpayers across the Golden State.

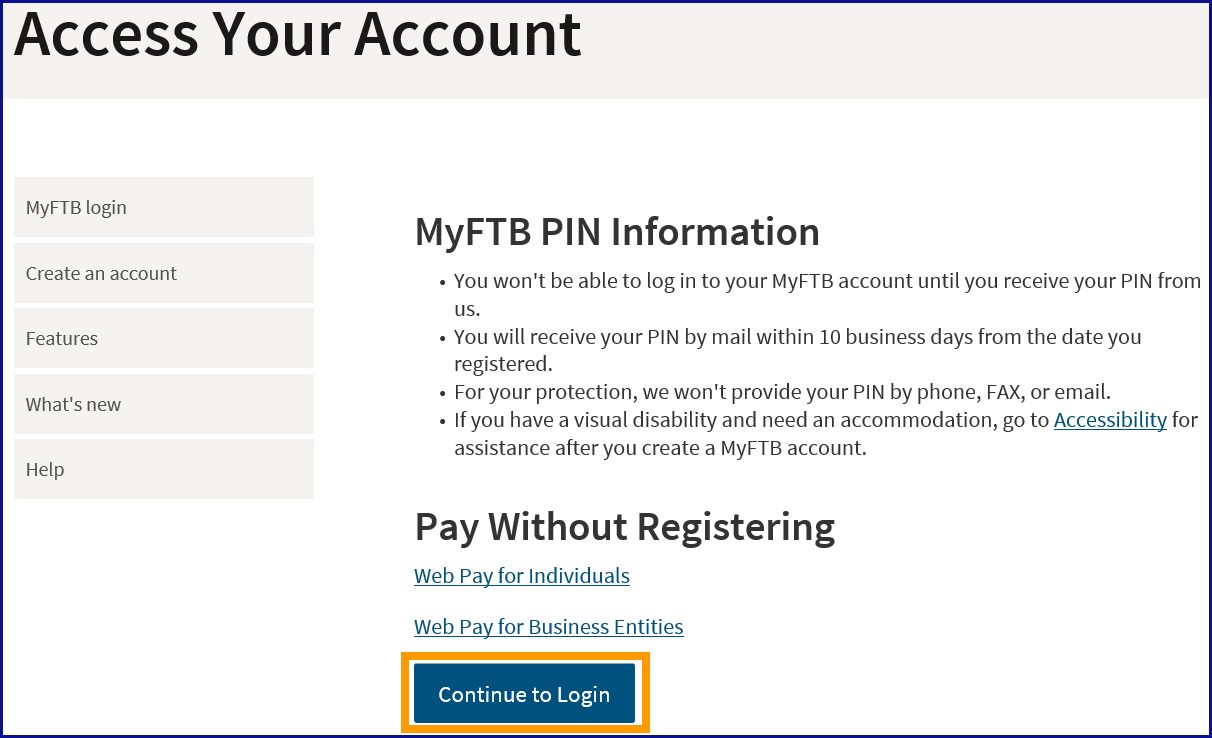

The FTB offers a comprehensive suite of online services designed to empower individuals, business representatives, and tax professionals. From filing your return and making payments to checking your refund status and accessing vital account information, the FTB website is your one-stop shop for all things tax-related in California. Log in to your MyFTB account to gain access to these resources, or explore the wealth of information available through the links to popular topics and online services. Instant confirmation is available to assure you that your return was received.

For those who are new to the process, or who are looking for a comprehensive guide, the following table provides a breakdown of key information regarding the California Franchise Tax Board, its functions, and related processes. This is a useful reference for understanding the services offered and for navigating the tax season with confidence.

| Feature | Details |

|---|---|

| Mission | To assist taxpayers in filing tax returns on time and accurately, and to ensure that the correct amount is paid to fund important services for Californians. |

| Services Offered |

|

| MyFTB Account | Provides online access for individuals, business representatives, and tax professionals to manage tax account information and utilize online services. |

| Refund Information |

|

| Payment Options | Includes payment options, information on collections, withholding, and assistance if you are unable to pay. |

| Forms and Publications | Offers easy access to forms and publications to assist taxpayers. |

| Account Information Access | Taxpayer account information is accessible only to individual taxpayers or their authorized representatives. Unauthorized access is unlawful as described in the California Penal Code Section 502. |

| Entity Type Selection | Requires selection of entity type and entry of entity ID when accessing services. The information must match FTB records. |

| Website Accessibility | The FTB strives to maintain a website that is user-friendly and easy to understand. |

| Google Translate | This feature is available for general information and is not intended for official business. Consult with a translator for official purposes. |

| Resources | The FTB offers 2024 instructions for Form 568 (Limited Liability Company Return of Income). |

| Tax Code References | References to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). |

| Entities Eligible for Entity Status Letters | Includes corporations and limited liability companies. |

| Updates Reflecting Time | Changes to entity names made through the Secretary of State may take up to 30 days to be reflected with the FTB. |

| Partner Agencies | The FTB collaborates with various agencies, including the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service. |

| Tax Calculator | This calculator helps in computing tax for some forms, but not for Form 540 2EZ. Use the 540 2EZ tax tables on the tax calculator, tables, and rates page. |

| California Franchise Tax Board Administration | Administers and collects state personal income tax and corporate franchise and income tax of California. |

| Estimated LLC Fee | Use form FTB 3536 to remit the estimated fee payment. Penalties and interest apply if payments are not made by the original return due date. |

Filing your California taxes doesn't have to be a source of stress. The FTB's website, accessible at any time, offers a user-friendly interface designed to guide you through the process. Whether you're a seasoned taxpayer or filing for the first time, you can access a wealth of information and online services.

Navigating the website is simple. You can file a return, make a payment, or check the status of your refund, all with just a few clicks. MyFTB login grants you easy access to your account, allowing you to view your tax information, make adjustments, and stay informed about any changes or updates. If you don't have an account, the website will guide you through the simple process of setting one up.

One of the most valuable features on the FTB website is the ability to check your refund status. You can typically expect your refund to arrive within 3 weeks if you filed a paper return, though some returns may require extra review, extending the processing time up to 3 months to ensure accuracy, completeness, and to protect taxpayers from fraud and identity theft. If the refund amount differs from what you expected, don't worry; the FTB will send you a letter explaining the difference. It's essential to wait for this letter before you contact the FTB, as it will provide all the necessary information.

The FTB understands that paying your taxes can sometimes be challenging. That's why they provide comprehensive information on payment options, collections, and withholding. If you find yourself unable to pay your taxes on time, the FTB offers resources to help you explore your options. You can access information about payment plans, offers in compromise, and other forms of assistance.

The FTB is committed to providing a positive user experience. The website is designed to be easy to navigate and understand. Their goal is to provide a good web experience for all visitors. To that end, the FTB offers a variety of resources, including FAQs, helpful articles, and contact information. If you have any questions or need assistance, don't hesitate to reach out to the FTB for help.

The FTB's mission goes beyond just collecting taxes. Their ultimate goal is to help taxpayers file their returns accurately and on time, and pay the correct amount of tax. The revenue collected by the FTB goes towards funding essential services that benefit all Californians, including education, healthcare, infrastructure, and public safety. When you file your taxes, you're not just fulfilling a legal obligation, you're contributing to the well-being of your community.

The FTB works in partnership with other state and federal agencies to ensure the smooth and efficient operation of the tax system. The agencies include the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service (IRS). This collaborative approach streamlines the tax process, minimizing confusion and maximizing efficiency for taxpayers. You can access all of the information and tools, via the main website, which is easily accessed. The agency's work is part of the California Government Operations Agency.

The FTB website provides various resources to assist you in meeting your tax obligations. You can easily access forms, publications, and helpful guides to help you understand the tax law and file your return accurately. You'll find the most up-to-date forms and publications online. By utilizing the FTB resources, you can ensure you have the information you need.

The FTBs website also provides you with the option to access their tax calculator and tables and rates pages. The site can figure the tax for you. This information and service saves you time and reduces the possibility of error.

Entities that are eligible to receive an entity status letter from the FTB include corporations and limited liability companies (LLCs). Also, the site explains that changes to entity names made through the Secretary of State may take up to 30 days to be reflected with the FTB. This is good to keep in mind so that you are not confused with the changes to your entity name.

For LLCs, if you are required to pay an estimated fee, you can use form FTB 3536 to remit the estimated fee payment. Remember that if you do not make your estimated LLC fee payment by the original return due date, you will be subject to penalties and interest. Make sure you visit the Due Dates for Businesses page, to ensure you do not miss any important deadlines.

The website's design incorporates a variety of accessibility features to make it easier for people with disabilities to use. In fact, it is easy to use and provides a good web experience for all visitors. These accessibility features include things like screen reader compatibility, keyboard navigation, and alternative text for images. You can easily file a return, make a payment, or check your refund.

When checking your refund, the site will ask that you declare under penalty of perjury that you are the taxpayer or authorized representative. This service has a variety of features. The website also offers MyFTB, check your refund, and my cod (whatever that may be.)

The FTB is committed to providing information and services in multiple languages. A Google translation feature is provided on the website for general information only. For official business, consult with a translator.

The California Franchise Tax Board (FTB) is an essential component of California's government, responsible for administering and collecting the state's personal income tax and corporate franchise and income tax. The board is composed of the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization. Their collective expertise ensures that the tax system operates efficiently and fairly.

Remember that the FTB offers instant confirmation to assure your return was received. Extra processing time may be necessary, so be patient when waiting to receive your return. The FTB is here to serve the people of California. The Boards mission is to serve the people of California.