Are you prepared for the ever-changing landscape of New York State taxes? Navigating the complexities of income tax, sales tax, and local levies demands meticulous attention and a keen understanding of the latest regulations.

The financial gears of New York State are constantly in motion, and staying informed is no longer optionalit's essential. This article serves as your comprehensive guide, providing insights into the critical elements of New Yorks tax system, from filing deadlines to available resources and potential financial pitfalls.

Let's delve into the specifics. As of March 1, 2025, changes to the collection of rent will be in effect. It's crucial to stay updated on these alterations to maintain compliance. Simultaneously, it's wise to review the filing due dates for corporation tax, personal income tax, and sales tax to prevent any penalties.

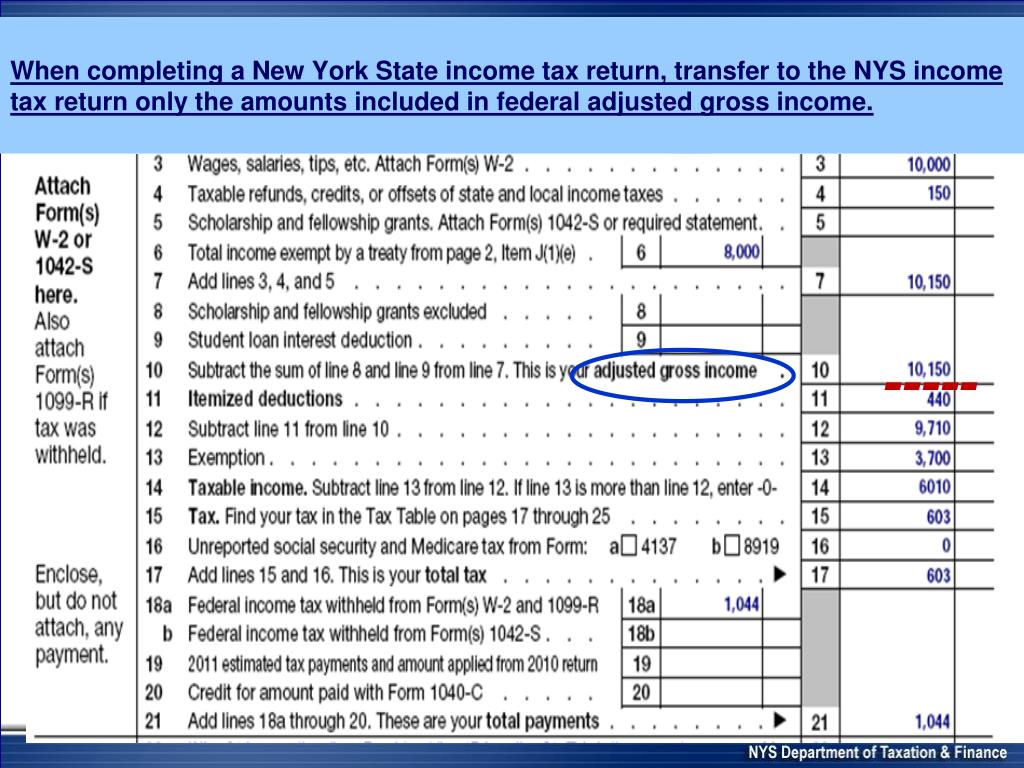

Understanding New York State's income tax rates and brackets is fundamental. These factors are directly applied to your taxable income, contingent upon your residency and filing status. Additionally, you must ascertain whether you are liable to pay local income taxes in New York City or Yonkers, and grasp how to calculate your total tax obligations. The state offers resources to aid in this process, ensuring that eligible New Yorkers can complete their state returns with speed and security, regardless of location.

In 2023, a free tool was provided to help calculate your New York State and local income taxes. This valuable resource aids in understanding your tax liability. Furthermore, the ability to compare tax rates, brackets, deductions, and exemptions based on different filing statuses and locations is a beneficial exercise. Staying updated with the most recent information, credits, and guidance for the 2024 tax season is vital, as it enables you to optimize your tax strategy.

Heres a table summarizing the key aspects of New York State Taxes:

| Tax Type | Description | Key Dates/Deadlines | Important Considerations |

|---|---|---|---|

| Income Tax | Tax on earnings, encompassing state and potentially local (NYC and Yonkers). | Filing deadlines vary; align with federal deadlines. Check the state's calendar for specific due dates. |

|

| Sales Tax | A 4% state sales tax, plus local taxes in cities, counties, and school districts. | Collection and remittance are ongoing, depending on the business's filing frequency. |

|

| Corporate Tax | Taxes levied on corporate profits. | Corporation tax filing deadlines align with federal tax deadlines. |

|

| Local Taxes | Taxes imposed by cities and municipalities, with local income taxes in NYC and Yonkers. | Varied, dependent on the municipality. |

|

For detailed information, you can check the official New York State website: New York State Department of Taxation and Finance

The cost of living and taxation in New York are topics of constant discussion. The state has some of the highest state and local income taxes in the nation. In fact, some sources indicate that this can constitute 5.8% of its residents' income. For a contrasting view, consider states like Alaska, Florida, Nevada, and South Dakota, where the absence of state income tax offers a substantially different financial environment.

Be mindful that some resources may not be entirely up-to-date, particularly forms and instructions. Ensure that you are consulting the most current versions available on the New York State Department of Taxation and Finance website. The site's organization, featuring options for filing, refunds, relief, and credits, serves as a robust resource for taxpayers.

Moreover, the state offers tools like the New York State tax calculator (NYSTax Calculator), which employs both the latest federal and state tax tables. For 2025/26 tax estimates, utilize the 2025 tax year option. This calculator provides a salary example with deductions applicable in New York. You can also access both IRS Direct File and New York State Direct File from various devices.

When filing, remember that you can pay your personal income tax along with your return. You can also pay income tax via online services, irrespective of your filing method. Payments can be made or scheduled up to the due date.

Taxpayers in New York have access to numerous resources, including the "Income Tax Filing Resource Center." This center is an excellent starting point for learning about filing, refunds, and other relevant tax-related topics.

Understanding your filing requirements is essential. Generally, if you are a New York State resident and meet specific conditions, you must file a state income tax return. These conditions often mirror the federal requirements. Moreover, the taxability of military pay is determined by residency. If you are a New York State resident, your military pay is taxable by the state to the same degree as federal income tax.

Consider the latest tax year information. The state's income tax rates were last adjusted two years ago, for the tax year 2022, with the tax brackets previously altered in 2021. New York utilizes nine marginal tax brackets, ranging from 4% to 10.9%. Each tax bracket applies solely to earnings within that specific bracket.

It is also noteworthy that the New York itemized deduction limitation for taxpayers whose New York adjusted gross income exceeds $10 million has been extended through tax year 2029. Additionally, income from pension plans described in section 114 of Title 4 of the U.S. Code, received while you are a nonresident of New York State, is not taxable to New York.

Pension and annuity exclusions could be available to those over 59 years of age. As you plan your tax strategy, note that the 2025 tax rates and thresholds, applicable to both New York and federal tax tables, are built into the New York tax calculator for 2025. This freely available tool can assist you in generating precise estimates for your 2026 tax return. Eligible New York taxpayers may consider using IRS Direct File to file their federal return.

Remember that Direct File will soon be accessible in Spanish, extending its reach to a wider segment of the population. The state has a variety of resources available, and it is imperative to be aware of all the tools available. This includes the "Income Tax Filing Resource Center," which serves as a helpful source.

When preparing your return, always enter the security code accurately. As a reminder, any website with the ".gov" suffix belongs to an official New York State government organization. In the event that your refund is not deposited in your account within 15 days of the scheduled date, verify the status with your bank.

As a final point, if you need more time to file and owe tax, it is imperative that you submit your extension payment by the original due date to avoid penalties and interest. By adhering to these guidelines and remaining proactive, taxpayers in New York can successfully maneuver the intricacies of the state's tax system.