Are you a public service employee in Washington State, planning for your retirement? Understanding the intricacies of retirement plans, benefits, and available resources is crucial for securing your financial future.

Navigating the world of retirement can feel overwhelming, particularly when dealing with the specific requirements of public service employment. The Washington State Department of Retirement Systems (DRS) offers a variety of plans tailored to the needs of state and local government employees. This article delves into the key aspects of these plans, providing you with the information you need to make informed decisions and prepare for a comfortable retirement.

The DRS oversees a complex landscape of retirement plans, designed to support the diverse public workforce of Washington State. These plans are not one-size-fits-all; instead, they are structured to accommodate the different needs of various employee groups. For instance, a pension plan established before October 1, 1977, has distinct attributes from those created later.

A fundamental aspect of planning is understanding how to access and manage your retirement account information. The DRS provides online access through its website, allowing you to view your account details for Plan 3 and the Deferred Compensation Program (DCP). Logging in provides access to your personalized account. If you're interested in investment-based plans, its good to know you can contact your record keeper to lock your DCP, Plan 3 or JRA investment account to help with security online. The system prioritizes the protection of your information, which is why DRS employees are highly trained in best practices for securing account information and understanding the threats to your personal data.

For those nearing retirement, the process involves several steps. The website includes a checklist designed to guide you through the process. You can learn how to access your DRS retirement accounts online or directly through Voya Financial. Before you fill out your forms or use the withholding calculator, you might want to speak with your tax advisor or the IRS, if you have questions about your taxes. You can also find valuable information for DCP, Plan 3, and JRA customers.

One of the most significant decisions you will make is choosing between Plan 2 or Plan 3, a choice you have 90 days to make. This decision is permanent, so carefully consider your options. You'll find that your choice will affect how your retirement benefits will be structured. Resources such as your plan handbook, available on the DRS website, contain eligibility rules and guide you through those choices. If you're in a situation where you are a member of more than one retirement system, you'll need to contact DRS to apply.

Understanding how to verify the accuracy of your service credit through online account access is another critical step in the process. It's essential to review your plan handbook for retirement eligibility rules to ensure you meet the requirements for receiving benefits. Should you find any discrepancies in your information, the DRS encourages you to contact them immediately.

To provide a comprehensive overview, the following table summarizes key aspects of Washington State's public service retirement plans administered by the DRS. This is a general guide, and specific details may vary depending on your individual circumstances and the specific plan you are enrolled in.

The following table contains some information for Public Employees' Retirement System (PERS):

| Category | Details |

|---|---|

| System Overview | The Public Employees' Retirement System (PERS) is a defined benefit pension plan for employees of the state of Washington, counties, cities, towns, public utility districts, and other local government entities. |

| Eligibility | Membership typically includes employees of state agencies and various local government entities who meet specific employment criteria. Eligibility requirements vary based on the plan and the date of hire. |

| Plan Choices | New hires often have a choice between Plan 2 and Plan 3. This is a crucial decision made within a specific timeframe (usually 90 days). Your plan choice is permanent. |

| Plan 2 | A traditional defined benefit plan that provides a guaranteed monthly retirement benefit based on years of service, age, and average final compensation (AFC). |

| Plan 3 | A hybrid plan that combines a defined benefit component (similar to Plan 2) with a defined contribution component, where the employee contributes a portion of their salary to an investment account. |

| Contributions | Both employees and employers contribute to the plan. Contribution rates vary depending on the specific plan and are subject to change. |

| Benefit Calculation (Plan 2 Example) | Monthly Benefit = Years of Service x 2% x Average Final Compensation (AFC) |

| Average Final Compensation (AFC) | AFC is the average of your 60 consecutive highest-earning months. |

| Online Access and Resources | Members can access their account information, view contribution details, and use retirement estimators through the DRS website. |

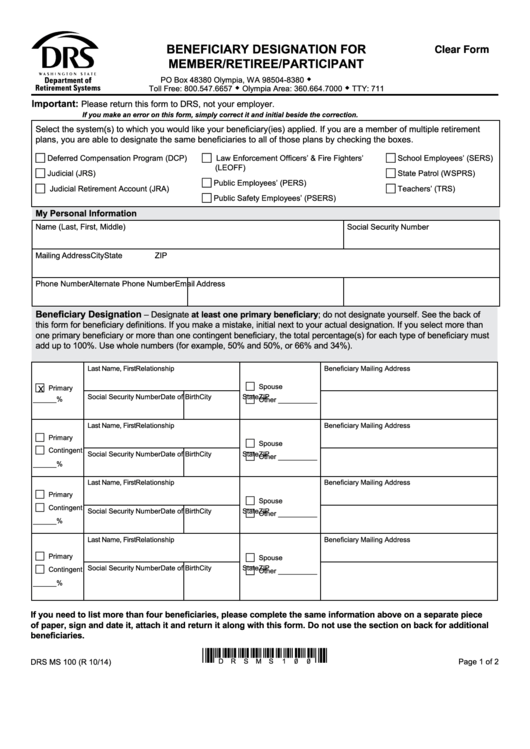

| Beneficiary Designation | Beneficiaries are usually designated on paper forms, as pension beneficiary designations cannot be changed online due to survivor benefit complexities. Upon your passing, your beneficiary would receive a lump sum of your contributions (and your survivor's passing, if applicable). |

| Contact Information | For fast, secure service, use your online account and the "Contact Us" tool. For additional DRS contacts, you'll receive the fastest service by contacting them with the means on the website. |

| Important Note | This is a general overview. Always refer to your specific plan documents and contact the DRS for detailed and up-to-date information. |

For More Information: Washington State Department of Retirement Systems Website

The Department of Retirement Systems (DRS) serves a broad audience of over 330,000 Washington public employees. The plans it administers include various retirement schemes across several distinct retirement systems, catering to diverse employee groups, like firefighters, teachers, and police officers. Led by Tracy Guerin and the DRS advisory committee, the department manages a highly intricate public retirement system composed of multiple plans, including those designed for public safety employees. Understanding these different plans is critical to properly planning for retirement.

Public safety employees have their specific retirement systems, with PSERS (Public Safety Employees' Retirement System) Plan 2 offering a pension plan designed for their needs. The benefits calculations, such as those based on the average final compensation (AFC), are calculated using your highest-earning months. This means your pension amount is directly related to your earnings throughout your career. Its worth noting that federal law may limit the amount you can contribute toward retirement and limit the benefit calculation for high-income public employees. As a public safety employee, if you have completed a certified criminal justice training course and are authorized to arrest, conduct criminal investigations, enforce criminal laws in Washington State, and carry a firearm, it's likely that you fall into a particular retirement system. It is very important to clarify the exact plan rules and requirements.

You are encouraged to take advantage of the online account services. Through the DRS website, you can find resources for Plan 3 and the Deferred Compensation Program, access your investment account information, and use tools like the retirement savings tap annuity calculator. From the DRS homepage, you can access your account, log in, and manage your information. Keep an eye on the timer; your session will expire if you're inactive for a certain period, and you'll need to start the registration process again if this happens during online account registration.

For convenient and efficient service, the DRS encourages the use of the "Contact Us" tool. You can contact the DRS at 800.547.6657 for Plan 3 or DCP contributions. This tool helps you to find answers to commonly asked questions about logging in and registering for online account access. Its important to regularly check your account information and update your beneficiaries as needed. Note that for retired members, beneficiary designations for pensions are done using paper forms.

The DRS provides information and tools to help you. The retirement plan guides provide detailed information on all retirement plans, including the rules, benefit information, and other key details for Washington State DRS pension customers. In order to help with your plans, access the website: hca.wa.gov. This checklist will walk you through the steps you'll take to retire with DRS.

As you prepare for retirement, keep these points in mind. The choices you make today will significantly impact your financial security in the years to come. By understanding the different retirement plans, taking advantage of online resources, and contacting the DRS with any questions, you can take control of your retirement journey and look forward to a secure and fulfilling future.