Is it possible that a city renowned for its high cost of living could also boast surprisingly low property tax rates? The answer, surprisingly, is yes, and that city is none other than New York City, where property owners enjoy some of the lowest effective property tax rates in the nation.

This seeming paradox stems from a unique combination of factors within the city's tax system. The reality is that New York City homeowners are paying an average of just 0.91% of their property's value in taxes, a figure that appears remarkably low when juxtaposed against the city's reputation for exorbitant expenses. The key to understanding this lies in how the city assesses the value of residential properties. Unlike many other jurisdictions, New York City uses a system where the taxable value of most residential properties is only 6% of their actual market value. This assessment methodology dramatically reduces the base upon which property taxes are calculated, leading to the relatively low effective rate that benefits many homeowners. This distinct approach to property valuation, coupled with a complex web of regulations, creates a tax landscape unique to the city.

Now let's break down the core elements of New York City's taxation system. The city has its own dedicated income tax, a critical piece of the financial puzzle for its residents. It is crucial to understand that this tax is separate and distinct from the state income tax that all New Yorkers must also pay. The city's income tax rates are not static; instead, they fluctuate from year to year, responding to various economic and budgetary considerations. The specific rate applied to an individual's income is contingent on a combination of factors, primarily their income level and their filing status (single, married filing jointly, etc.). This means that the tax burden is tailored to each individual's financial circumstances, reflecting a progressive tax system that aims to balance the needs of the city with the financial capabilities of its residents.

To delve further into the financial realities of living and working in the city, consider the following table that outlines the tax implications for a single filer earning $70,000 annually. Based on information available on the TurboTax website, a single individual with this income level would be taxed $13,698. This equates to an average tax rate of 14%, emphasizing how quickly taxes can impact the take-home pay. The Department of Finance (DOF) is the administrative body responsible for overseeing various aspects of the city's tax regime, including business income and excise taxes. The DOF plays a critical role in ensuring the smooth operation of the city's finances, effectively collecting and managing a substantial portion of the city's revenue.

A significant factor influencing the overall tax burden in New York City is the interplay between state and city tax credits. Many tax credits designed to ease the tax burden overlap, and these credits can provide welcome financial relief. For example, taxpayers eligible for the New York State Earned Income Tax Credit (EITC) automatically qualify for a corresponding city credit. These credits offer targeted financial assistance, especially to low- and moderate-income families, mitigating the financial strain of city living.

| Category | Details |

|---|---|

| Overview of Taxes | New York City levies income tax on top of federal and state taxes; property taxes are comparatively low, averaging 0.91% of property value. |

| Income Tax Structure | City income tax rates range from 3.078% to 3.876% based on income; New York State also has a progressive income tax from 4% to over 10%. |

| Property Tax System | Property taxes account for 44% of the city's tax revenue (FY2024); the taxable value of residential property is just 6% of the market value. |

| Tax Year | Property tax year runs from July to June; the 2024 tax year rates are determined by the City Council. |

| Filing and Credits | Taxpayers may qualify for overlapping state and city tax credits; many free filing options are available. |

| Tax Rates in 2024 (for 2025 filing) | NYC income tax rates: 3.078%, 3.762%, 3.819%, 3.876% |

| Impact on Income | A $100,000 salary in NYC equates to just over $30,000 after federal, state, and city taxes. |

| Standard Deduction | For 2025, the standard deduction is $8,000 for single filers and $16,050 for married filing jointly. |

| Where to Pay | Payments must be made through the DOF website or apps. |

For those wondering how the tax burden in the city stacks up, consider that a $100,000 salary in New York City equates to just over $30,000 after all taxes. This startling figure underscores the impact of federal, state, and local taxes on an individual's take-home pay, highlighting the significant financial commitment required to live in the city. The rates you'll pay are based on your income level and filing status. The city's income tax rates, for the 2024 tax year (taxes filed in 2025), are structured progressively, which means that the percentage of income you pay in taxes increases as your income rises. This progressive structure is intended to ensure that those with higher incomes contribute a larger share to the city's financial resources, reflecting principles of fairness and equity.

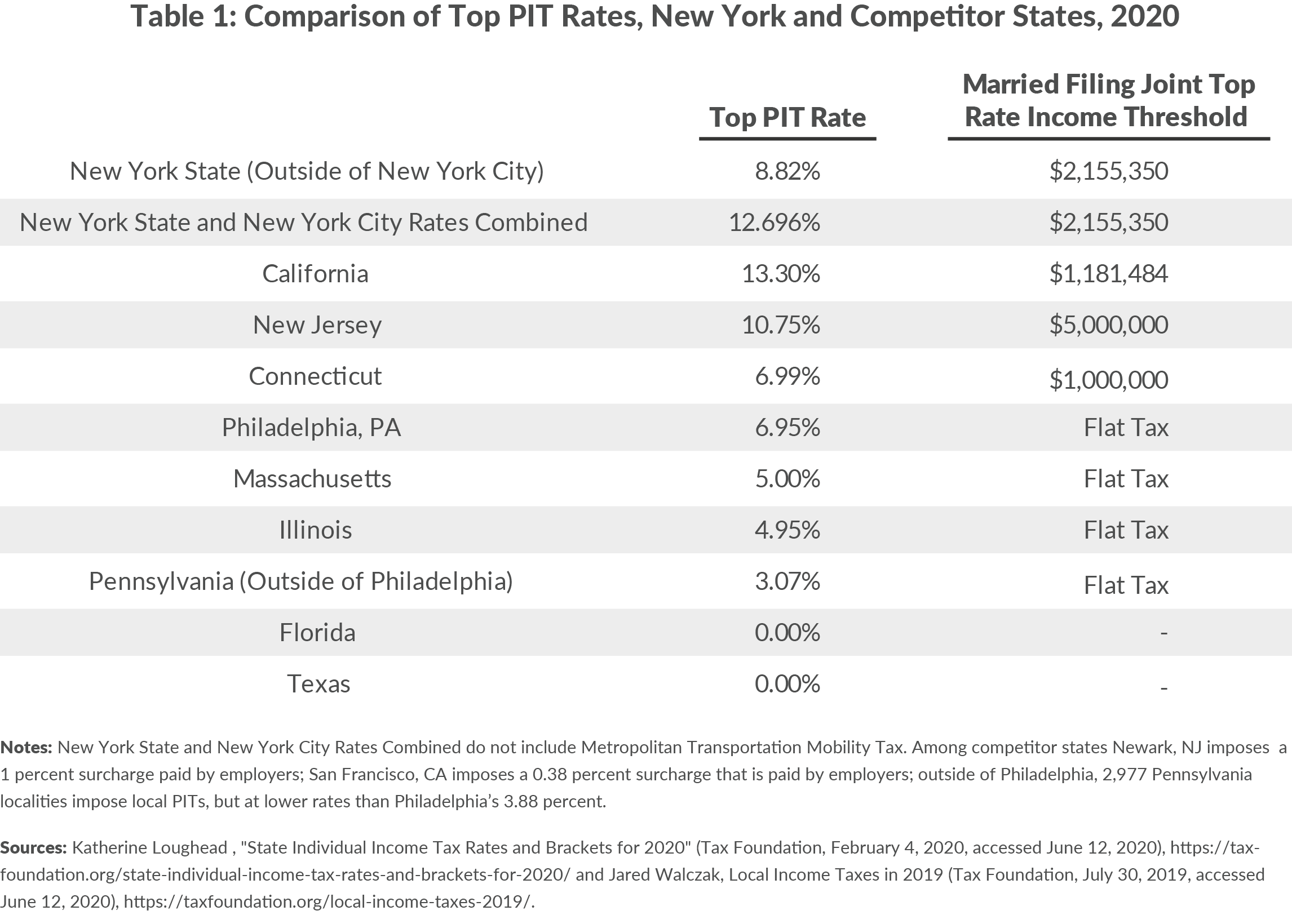

The complexities don't end there. The city's income tax system operates separately from the state's tax system, although both are interwoven. While New York State's tax rates range from 4% to 10.9% depending on income, the city's rates, though lower individually, add an additional layer of taxation for residents. The result is a combined tax burden that can significantly affect an individual's or a family's financial situation. The need to pay both city and state income taxes is a fundamental aspect of financial planning for all New York City residents. The city's income tax rates are 3.078%, 3.762%, 3.819% and 3.876% depending on your tax bracket and filing status.

When filing your taxes, it's important to remember that the New York City income tax is added to the New York State income tax. This overlapping taxation is a key characteristic of the city's financial landscape, distinguishing it from many other areas in the United States. Property taxes in New York State vary considerably based on whether you live in New York City or elsewhere. Unlike sales tax, residents of the city benefit from relatively lower property tax rates. However, the cost of homes in the city remains high, with a median price of $700,000 as of 2023, emphasizing the high overall cost of homeownership. In the fiscal year 2024, which concluded on June 30, 2024, property tax revenues accounted for a substantial 44% of all tax dollars collected by the city. The distribution of these tax dollars is a key indicator of the city's priorities, with 25% allocated to uniform agencies, including the police, fire department, sanitation, and corrections. These agencies are fundamental to the city's functioning, contributing to public safety and the well-being of its residents.

The tax year for properties in New York City operates differently from the typical tax season, commencing in July and concluding in June of the following year. This unique cycle is vital for understanding property tax payments. This is why property taxes in the city for any given year, including 2024, would be categorized into two segments: the first half of the year, already completed, and the second half, still ongoing. New York City's income tax system, like the federal income tax, is structured progressively. This progressive approach means the rate of taxation rises as a taxpayer's taxable income increases. The structure ensures that those with higher incomes bear a larger share of the city's financial burden, reflecting the principles of equity and fairness. For 2025, the income tax rates in New York City are set to range from 7.078% to 10.90%, a further illustration of the progressive nature of the city's tax system.

For anyone filing taxes in New York City, it's essential to understand that there's a standard deduction. For single filers, this deduction is set at $8,000, while those who are married and filing jointly can deduct $16,050. This deduction can significantly reduce the amount of your income that is subject to taxation, providing financial relief to residents. If you're a resident, you'll have to pay the city income tax, in addition to state and federal taxes. And, if you're looking for free options to file, you can use NYC Free Tax Prep. They have several ways to file, including completing your return on your own or having a preparer available via phone or email to answer any questions.

Online payment for city property taxes, along with other fees and fines, is exclusively available through the Department of Finance website and its related applications. While the city may collaborate with vendors, the DOF doesn't endorse or permit any external applications or websites to facilitate these payments. New York City has additional local income tax with rates ranging from 2.55% to 3.88% for higher income earners, making it an area with one of the highest combined state and local tax burdens. These changes apply to collections of rent on and after March 1, 2025. The deadline for filing your 2024 tax return is April 15, 2025.

Every property in New York City is assigned to a tax class. Tax class 1, tax class 2, and tax class 4 are some of them. The city council sets the tax rates annually, usually in November. The city council adopted new property tax rates for the tax year that began on July 1, 2024, and ends June 30, 2025. The New York State has a progressive individual income tax, with rates ranging from 4.00 percent to 10.90 percent. There are also jurisdictions that collect local income taxes.

So, while the city may seem complex, with its unique tax landscape, understanding these nuances can help you navigate the financial realities of New York City life with greater clarity.