Are you one of the over 157,000 active members of the School Employees Retirement System of Ohio, or someone planning for the future? Understanding the complexities of your retirement plan is paramount to securing your financial well-being in the years to come.

Welcome to the members' area of SERS' website. For those navigating the landscape of retirement, particularly within the realm of public service in Ohio, the School Employees Retirement System (SERS) stands as a pivotal institution. SERS, a pension fund specifically designed for Ohio school employees, offers a comprehensive package encompassing retirement, savings, and healthcare benefits. This article serves as your guide, navigating the key aspects of SERS, its offerings, and how they relate to your long-term financial security.

To facilitate a deeper understanding, let's delve into a structured overview of the School Employees Retirement System of Ohio (SERS). The details presented below summarize the critical features of this pension system.

| Category | Details |

|---|---|

| Purpose | A pension fund providing retirement, savings, and healthcare benefits for Ohio school employees. |

| Membership | Open to active members of the School Employees Retirement System of Ohio, with over 157,000 active members. |

| Eligibility | Determined by employment within the Ohio public school system and adherence to the specific criteria set forth by SERS. |

| Benefits Offered | Retirement allowances, disability benefits, survivor benefits, and access to health care coverage. |

| Types of Retirement | Offers two primary retirement options: Unreduced Service Retirement and Early Service Retirement with Reduced Benefits. |

| Healthcare Coverage | Provides access to healthcare information and coverage, including enrollment, cancellation, plan options, premiums, and details on dental, vision, and Medicare. Aetna offers a suite of benefits for SERS retirees enrolled in Medicare. |

| Dental and Vision Coverage | Available through Delta Dental of Ohio and VSP Vision Care. Eligibility requires eligibility for, but not necessarily enrollment in, SERS' healthcare coverage. |

| Service Credit | Calculation based on the length of service in an Ohio public service job and final average salary (the average of the three highest years of salary). |

| Investment Returns | Managed investments, contributing to the overall funding of the pension plan. |

| Social Security Implications | Awareness and understanding of how SERS benefits interact with Social Security benefits, considering the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). The Social Security Fairness Act, signed on January 5, 2025, repeals both WEP and GPO. |

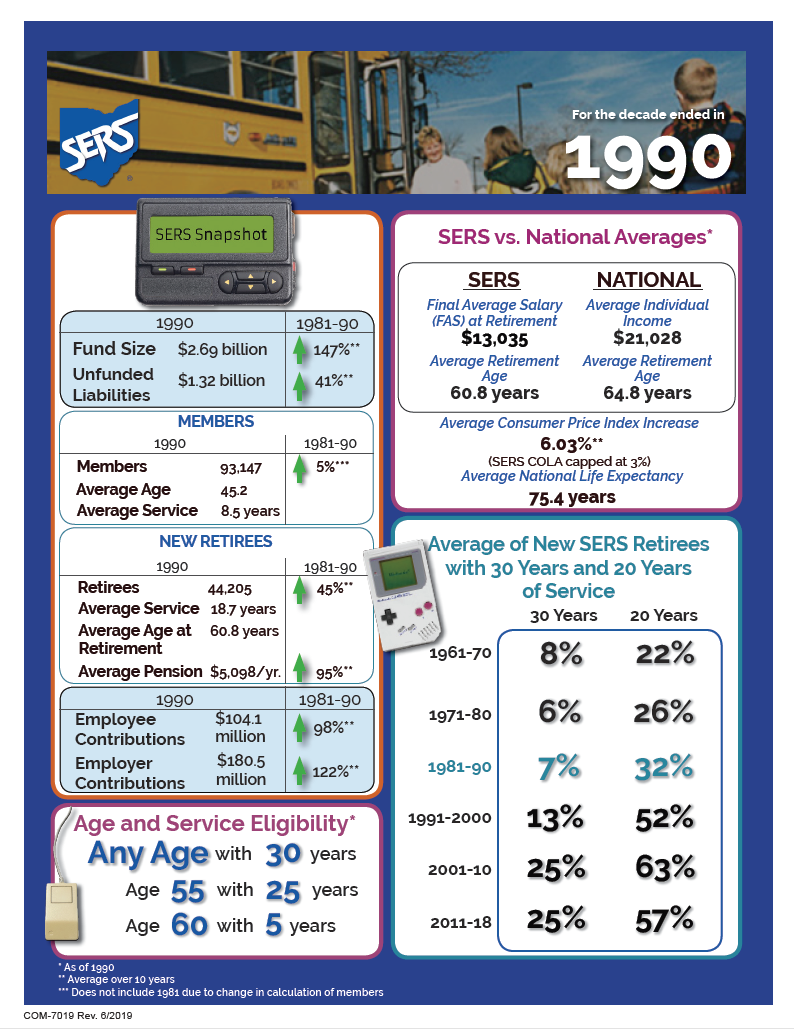

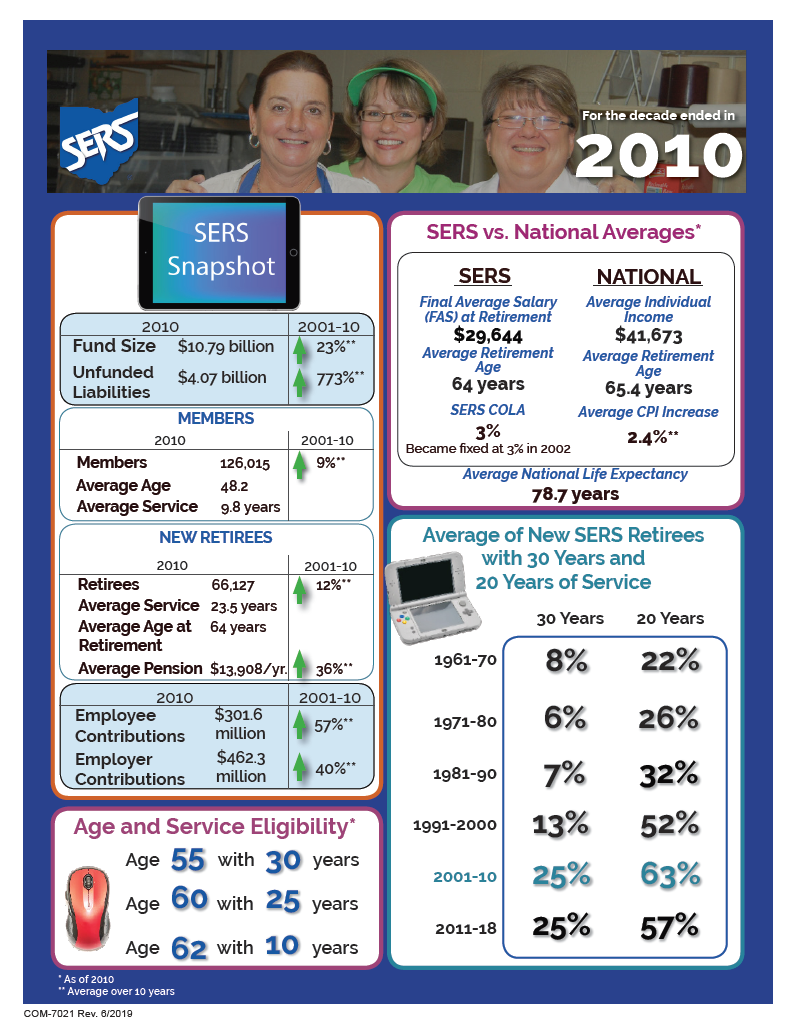

| Transparency and Financial Documents | Publishes financial documents, including administrative expense reports and historical financial information, available for public access and review. |

| Additional Resources | Provides access to numerous forms and publications to assist retirees and employers, including retirement guides, enrollment information, healthcare details, tax and pension information, newsletters, and handouts. |

| Related Organizations | Sero, a voluntary organization for current and retired school employees in Ohio, providing supplemental benefits, discounts, news, and advocacy for its members. |

| Contribution Report | The responsibility of the employer, detailing the employees for whom contributions are reported and remitted. |

| Location | Headquartered at 300 E. Broad St., Suite 100, Columbus, Ohio 43215. Free parking is available in the SERS parking garage, accessible from Grant Avenue. |

| Contact and Public Records | Offers contact information, information for media/public records requests, and details on hours of operation. |

| Reference | Official SERS website: www.ohsers.org |

The School Employees Retirement System of Ohio (SERS) is not an isolated entity but operates within a broader context of public employee pension programs in the state. Ohio public employees are eligible to participate in three distinct pension programs: the State Teachers Retirement System (STRS), the School Employees Retirement System (SERS), and the Public Employees Retirement System (PERS or OPERS). Each system has its specific rules, eligibility criteria, and benefit structures, yet they share the common goal of providing financial security to their members. Though retirement benefits are the primary focus, these plans also offer crucial survivor and disability benefits, addressing a range of life events that may impact a member's ability to work and earn income. Understanding these differences is key for members as they navigate their retirement planning.

SERS members, and indeed all public employees in Ohio, should be aware of the crucial role of service credit. This is the metric used to calculate retirement benefits. The longer you work in a covered position, and the higher your salary, the greater your benefit will be. For unreduced service retirement, the maximum pension amount is based on service credit and final average salary. Final average salary is typically the average of the three highest years of salary. Conversely, early retirement options can reduce benefits, offering flexibility for those who choose to retire before meeting standard age or service requirements.

A significant piece of legislation impacting many public workers, including potential SERS members, is the Social Security Fairness Act. President Joe Biden signed this into law on January 5, 2025. This act's implications are significant: it repeals both the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions previously affected the benefits of many public workers. For over 3 million workers, this act is positive news, potentially increasing their Social Security income alongside their pension. For SERS members planning for retirement, it's important to understand how these changes will impact their financial situation.

Beyond the core benefits, SERS offers additional supportive programs. For instance, it provides dental and vision coverage through established providers like Delta Dental of Ohio and VSP Vision Care. Those eligible for, though not necessarily enrolled in, SERS health care coverage can sign up. This coverage enhances overall well-being, a vital consideration for retirement. Additionally, SERS offers resources like forms and publications, including retirement guides, enrollment materials, and health care information. The system also has published financial documents, ensuring transparency and promoting informed decision-making.

For those looking for supplementary benefits, Sero, or the School Employees Retirement Organization, offers additional benefits, discounts, news, and advocacy for its members. Founded by a retired school employee, this voluntary organization provides a sense of community, further emphasizing the commitment to the well-being of SERS members. It underscores that retirement planning extends beyond financial considerations; it includes ongoing support.

SERS' commitment to transparency is evident in how it presents financial information. They publish financial documents that show income, expenditures, and funding progress. Monthly and yearly administrative expense reports are available for download. This commitment to transparency makes it easier for members to understand the health of the system and how it operates.

The day-to-day operations of SERS are centered in Columbus, Ohio, at 300 E. Broad St., Suite 100, 43215. SERS provides free parking, which is convenient for members and employers. The parking garage entrance is conveniently located at Grant Avenue, just north of Broad Street.

For those considering retirement, SERS encourages proactive planning. Contact information, media and public records request procedures, and operating hours are readily available. These resources provide critical support and address questions. Members are encouraged to understand their plans and how they work, as well as how their benefits will be calculated. Contacting the system with the most service credit is recommended if service credit is divided across multiple systems.

The School Employees Retirement System of Ohio (SERS) is a complex but vital system designed to provide financial security for Ohio's school employees. Members are encouraged to actively participate in their financial futures, taking advantage of available resources, remaining aware of legislative changes, and seeking information when questions arise. In doing so, members can ensure they have a strong foundation for a secure and fulfilling retirement.