Are you ready to navigate the complexities of California taxes? The California Franchise Tax Board (FTB) provides a comprehensive suite of online services designed to streamline your tax obligations and ensure compliance with state regulations.

Whether you need to file a return, make a payment, or simply check the status of your refund, the FTB's digital platform offers a convenient and accessible way to manage your tax responsibilities. The FTB's mission is clearly defined: to assist taxpayers in filing their returns accurately, on time, and to remit the correct amount due, thereby supporting the crucial services that are essential to all Californians. The FTB, an integral part of the California Government Operations Agency, is committed to providing these services efficiently and effectively.

The following table summarizes key functionalities offered by the FTB, catering to both individual and corporate taxpayers:

| Service | Description | Accessibility |

|---|---|---|

| File a Return | Provides a pathway for individuals and businesses to submit their tax returns online. | Accessible via the FTB website and potentially through the FTB mobile app. |

| Make a Payment | Enables taxpayers to pay their taxes online using Web Pay, facilitating secure transactions from their bank accounts. Payment scheduling is also available, up to one year in advance. | Web Pay via the FTB website and the FTB mobile app. |

| Check Your Refund | Allows taxpayers to monitor the status of their California state income tax return refunds. | Accessible via the FTB website and the FTB mobile app. |

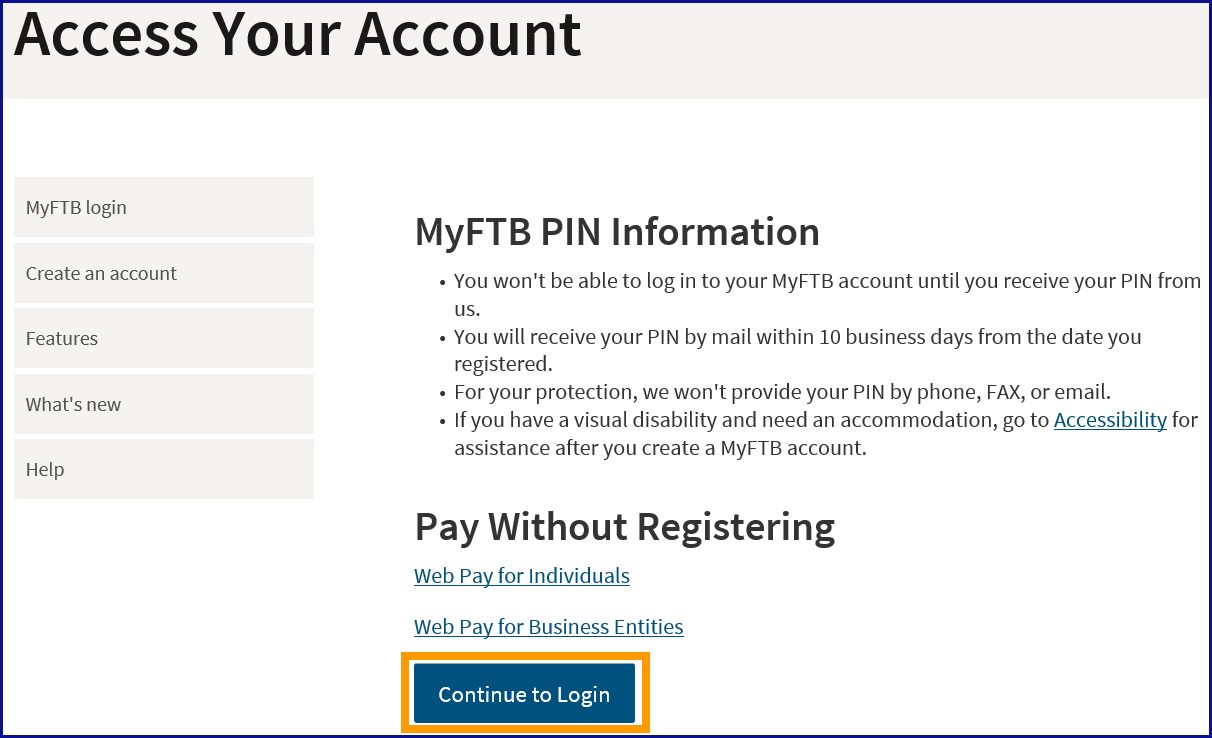

| Log in to MyFTB Account | Provides secure access to a personalized account for managing tax information. | Requires user authentication. |

| Access Popular Topics and Online Services | Directs users to frequently accessed resources and services. | Navigation links available on the FTB website. |

| Find Tax Forms and Publications | Provides access to tax forms and publications from 2008 to the present. | Searchable database on the FTB website. |

| Mobile App | The FTB Mobile App is an official app of the franchise tax board | Available to download from app store |

The FTB website, last updated on January 15, 2025, is committed to accessibility, as demonstrated by its certification dated July 1, 2023, reflecting its commitment to inclusive design. The FTB has confirmed that its website is designed, developed, and maintained to be accessible, as per California Government Code sections 7405 and 11135. The commitment ensures that all Californians, regardless of their abilities, can use the FTB's online resources.

The FTB's online services are designed to accommodate diverse user needs. For example, individuals who have received a notice from the FTB, requesting them to file a California tax return, can find assistance on the website to resolve any questions they may have. The website provides resources to guide individuals through the filing process.

For those needing assistance with forms, the website features a comprehensive form search tool. This allows users to locate tax forms and publications dating back to 2008. Additionally, the FTB mobile app provides a convenient way to access key functionalities on the go. This ensures that taxpayers have access to vital services regardless of their location.

The FTB's commitment to accessibility is demonstrated by its adherence to the requirements outlined in the California Government Code. The website's design and functionality have been certified as compliant with sections 7405 and 11135.

To access certain services, such as checking the refund status or accessing a personal MyFTB account, users may be required to enter their social security number and last name. It is crucial that this information matches the records held by the FTB to ensure secure access.

The FTB also provides specific options based on entity type. Businesses are required to select their entity type and enter their entity ID. This allows for the processing of tax-related requests. In such cases, users are reminded that updating the entity type field may cause other fields on the page to be updated or removed.

The FTB recognizes that some requests may require specific procedures. For example, when requesting an entity status letter, there might be a delay in updates, especially regarding the entity name.

For assistance in Spanish, users can access information in Del franchise tax board sobre la recaudaci\u00f3n. Additionally, users can call 800.338.0505 and enter a form code to request a notice by mail.

The FTB's dedication to accuracy and timeliness in tax filing is crucial for generating revenue for essential state services. Every effort is made to ensure that taxpayers can fulfill their obligations effectively. By offering online services, mobile applications, and readily accessible resources, the FTB seeks to empower Californians to manage their tax responsibilities with ease and confidence.

The board is composed of the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization.

The California Franchise Tax Board (FTB) is committed to ensuring its online resources are accessible to all users, as evidenced by its certification of accessibility. The website is designed, developed, and maintained to comply with California Government Code sections 7405 and 11135. This commitment is consistent with the FTB's mission to facilitate accurate and timely tax filings.

This website contains information that can assist you in filing a tax return and resolve any questions you may have about the notice you received. Individuals can use this web application to: launch service department website contact.

Remember, the information provided here is for informational purposes only and does not constitute professional tax advice. Always consult official FTB resources or a qualified tax professional for personalized guidance.