Are you a tax professional seeking a powerful, reliable, and user-friendly software solution to streamline your practice? Drake Tax software offers a comprehensive suite of tools and features designed to simplify tax preparation, enhance efficiency, and ultimately, empower you to serve your clients more effectively.

In today's complex tax landscape, the right software can make all the difference. Drake Tax has established itself as a leading provider in the professional tax preparation industry, offering a complete, professional, and comprehensive solution that caters to a wide range of tax needs. From personal to business returns, federal to state filings, Drake Tax provides the functionality and support necessary to navigate the intricacies of tax preparation with confidence. Whether you are a seasoned CPA, an enrolled agent, or a tax professional looking to elevate your practice, this software offers a robust platform to manage your clients' tax obligations efficiently and accurately.

For those new to Drake Tax, or seeking to learn even more, Drake offers a variety of resources, including free trials, demos, webinars, and detailed information on pricing and support services. This allows potential users to experience the software firsthand, understand its capabilities, and determine if it aligns with their specific needs. You can easily manage your Drake software user account, and find answers to frequently asked questions, the company provides comprehensive support, ensuring that users have the resources they need to succeed.

Drake Tax is more than just a software provider; it's a partner for tax professionals. The software allows you to prepare various forms like 1040, 1065, 1120, 1041, 990, 709, and many more, all within a single, integrated platform. This unified approach eliminates the need for multiple software packages and simplifies the entire tax preparation process. Moreover, Drake offers training courses led by software experts such as Ann Campbell, CPA, and Bethany Virga. These courses provide valuable insights, enhance skills with advanced tax topics, and offer up to 16 CPE hours, allowing tax professionals to stay current with the latest tax law changes and best practices.

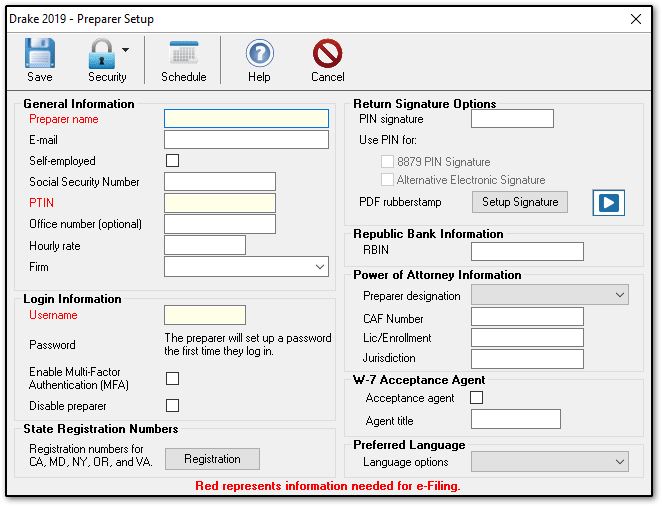

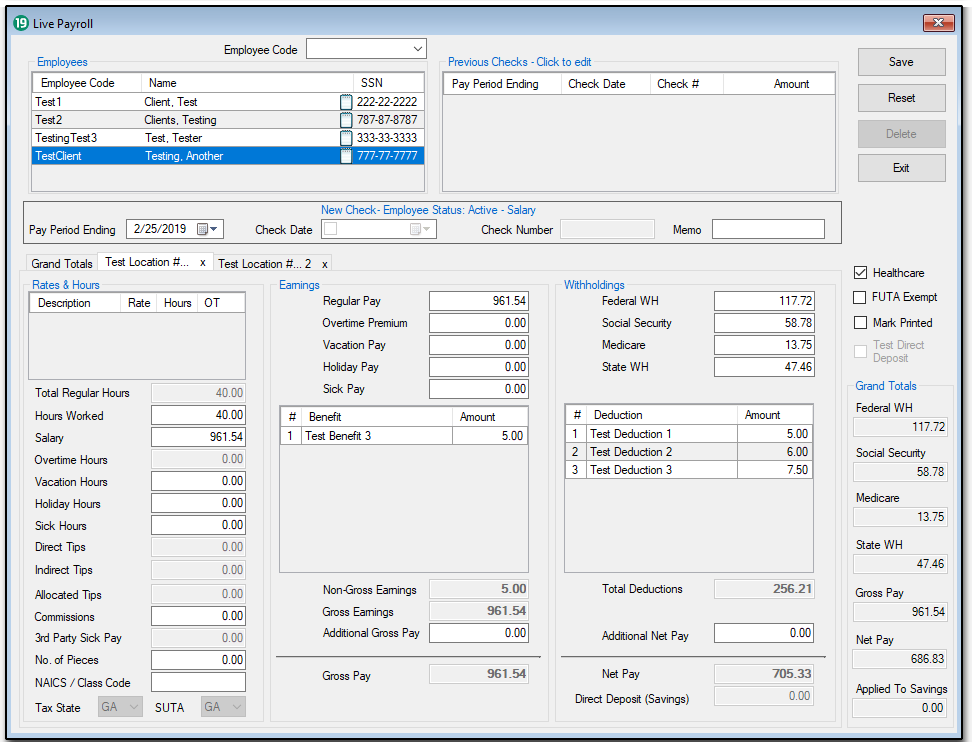

The software is also designed with a straightforward installation process. By following the simple directions provided in the quick start tutorial, users can quickly set up and begin using Drake Tax. The Drake download center provides clear instructions on downloading and installing both federal and state programs, making the setup process as seamless as possible. Users can easily enter their account and serial number, select the tax year and states, and follow the installation wizard to get started. Furthermore, the ability to open prior-year programs in trial mode allows for file conversion, ensuring a smooth transition for users migrating from other tax preparation software.

The company's history dates back to 1977, with its headquarters located in Franklin, North Carolina. Over the years, Drake Tax has built a strong reputation within the professional tax preparation industry, earning the trust of tax professionals nationwide. The company is committed to providing the tools and support tax professionals need to build their businesses and attract new clients. Drake also offers advanced features, like customizable cabinets, drawers, and folders for organizing documents, as well as integration with Drake Portals (SecureFilePro) for client file exchange and offsite backup. Moreover, Drake accounting is available in two versions: Forms Edition and Professional Edition. The Forms Edition is available for $395.

Drake has been dedicated to improving user experience over the past years. This includes updates to make the product suite easier to use, more efficient, and a more comprehensive product suite. Drake Portals are secure client file exchange sites that allow you and your clients to securely exchange confidential tax documents. You can use filters for just the clients you want, and customize letters with keywords and conditional paragraphs.

Drake tax preparer has a clear definition as defined by the Internal Revenue Code, is any individual who prepares a tax return for compensation. This includes, but is not limited to, CPAs and enrolled agents. A person who enters tax information while being employed, such as a data entry clerk, is not considered a tax preparer and does not need a PTIN, as they are not recommending or advising on tax positions, interpreting the tax law, or making any judgments on tax positions.

For those looking to understand the basics of Drake Tax, there are short instructional videos with content that includes closed caption, enabled by clicking [cc] in the video or its summary. You can also prepare for the future by converting files by opening prior year program in trial mode.

In an era where security and convenience are paramount, Drake Portals offer secure client file exchange sites, ensuring that sensitive tax documents are transmitted securely and conveniently. This feature not only enhances client trust but also streamlines the workflow by eliminating the need for paper-based exchanges. The software's integration with Drake Documents and Drake Scheduler further adds to its efficiency, providing a comprehensive suite of tools that caters to the various aspects of tax practice management.

Drake Tax software is available in two primary editions: Forms Edition and Professional Edition. The Forms Edition offers a cost-effective solution for users who primarily require access to tax forms and basic functionalities, while the Professional Edition offers a more comprehensive suite of features and tools, tailored for tax professionals who require advanced capabilities and increased efficiency. This allows users to select the edition that best suits their specific needs and budget.

The company remains committed to providing the tools, resources, and support tax professionals need to thrive in a dynamic tax environment. This includes ongoing software updates, responsive customer support, and educational opportunities such as webinars and training courses. Drake's dedication to its users underscores its position as a trusted partner for tax professionals nationwide.

Drake's dedication to providing a comprehensive, user-friendly, and reliable tax preparation solution makes it an appealing choice for both new and experienced tax professionals. With a rich history, a commitment to innovation, and a comprehensive suite of features, Drake Tax is well-positioned to support the evolving needs of tax practitioners for years to come.