Are you ready to navigate the complex world of taxes with confidence? Understanding your tax obligations and having easy access to the resources you need is no longer a privilege but a necessity in today's fast-paced world.

In the realm of governmental financial operations, the California Franchise Tax Board (FTB) stands as a crucial entity, serving as a cornerstone for both individual and corporate fiscal responsibilities. As a vital arm of the California government, the FTB meticulously manages the collection and administration of state taxes, ensuring the smooth operation of public services and initiatives. From income taxes to franchise taxes, the FTB is responsible for a diverse array of fiscal tasks that directly impact the financial landscape of California.

The FTB's mission goes beyond mere tax collection; it's about providing accessible services and support to taxpayers. Through its online portal, MyFTB, individuals and businesses can gain access to their tax account information, manage their filings, and stay informed about their financial obligations. This digital platform represents a significant step toward taxpayer empowerment, providing a user-friendly interface that streamlines the often-complex process of tax management.

The operations of the FTB are conducted within a framework of transparency and compliance. The agency adheres to strict guidelines to ensure that its practices are fair, equitable, and aligned with state regulations. The FTBs commitment to accessibility is also evident in its efforts to make its website and services inclusive for all users, including those with disabilities.

For those seeking to engage with the FTB, a multitude of resources are readily available. The agency's website is a treasure trove of information, offering everything from tax forms and publications to payment options and guidance on various tax-related matters. Taxpayers can also reach out to the FTB via phone or visit their offices to receive personalized assistance and resolve any queries they may have. The FTBs dedication to providing comprehensive support underscores its commitment to assisting Californians in fulfilling their tax responsibilities effectively.

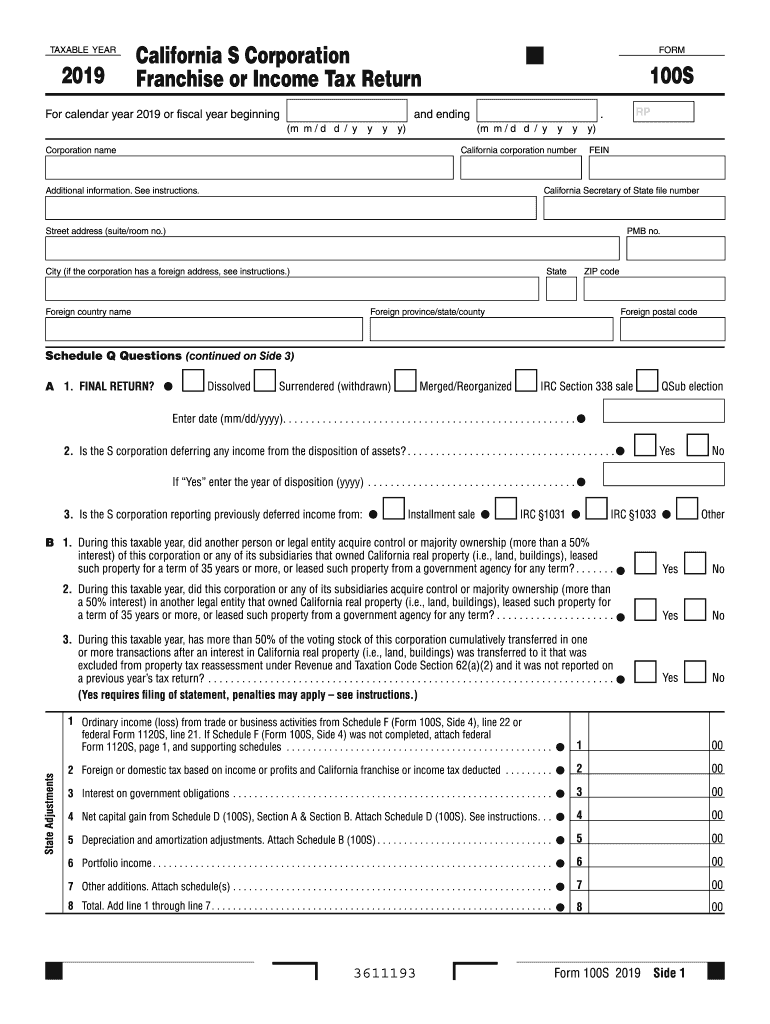

The following table encapsulates the essential aspects of the California Franchise Tax Board (FTB), a vital component of the California government responsible for administering and collecting state taxes. This overview highlights the board's structure, responsibilities, and the crucial role it plays in the state's financial ecosystem. This helps the user understand and connect the information in a structured way.

| Category | Details |

|---|---|

| Official Name | California Franchise Tax Board (FTB) |

| Primary Function | Administers and collects state personal income tax, corporate franchise tax, and corporate income tax. |

| Legal Status | California State Agency, part of the California Government Operations Agency. |

| Leadership Composition |

|

| Services Provided |

|

| Online Portal | MyFTB (online portal for accessing tax account information and services) |

| Key Responsibilities |

|

| Partner Agencies | California Tax Service Center (provides information and services for various taxes and fees) |

| Accessibility Compliance | The FTB website is designed, developed, and maintained to be accessible. This is in compliance with California Government Code sections 7405 and 11135. |

| Contact Information | Available on the FTB website and via phone. |

| Website Reference | California Franchise Tax Board Official Website |

The California Franchise Tax Board (FTB) is committed to helping taxpayers manage their state taxes efficiently and effectively. One of the primary tools for accomplishing this is MyFTB, an online portal designed to streamline the process of accessing tax account information and managing tax-related tasks. Through MyFTB, individuals, businesses, and tax professionals can access a wealth of resources and services, all designed to simplify the complex world of California taxes.

MyFTB serves as a central hub for various tax-related activities. Taxpayers can log in or create an account to check their refunds, view their payment history, and access important notices from the FTB. The platform offers a secure and user-friendly interface, ensuring that taxpayers can easily navigate and understand their tax information. MyFTB enables users to file, pay, and manage their state taxes online, eliminating the need for paper forms and manual processes.

For those looking to make payments, MyFTB offers a variety of convenient options. Taxpayers can make payments online using their checking or savings accounts or credit cards, providing flexibility and ease of use. Payment plans are also available, providing taxpayers with options to manage their tax obligations over time. The FTB also provides information on interest and penalties, ensuring that taxpayers are aware of the potential consequences of late payments or non-compliance.

The FTB understands the importance of providing comprehensive support to taxpayers. The FTB's website serves as a primary source of information, offering a wealth of resources, including tax forms, publications, and answers to frequently asked questions. Taxpayers can find assistance with filing, paying, and checking refunds, ensuring that they have access to the tools and information they need to fulfill their tax responsibilities. Furthermore, the FTB provides free tax help through various channels, helping taxpayers navigate complex tax scenarios.

Beyond the core services, the FTB also provides resources for various tax types. This includes information on income tax, payroll tax, and sales and use tax, among others. Taxpayers can find forms, publications, payment options, and the latest news related to these tax categories. This ensures that taxpayers have access to the specific information they need to address their tax obligations.

The FTB's commitment to accessibility extends to its online presence. As of July 1, 2023, the FTB's website is designed, developed, and maintained to be accessible. This is in compliance with California Government Code sections 7405 and 11135, ensuring that all users, including those with disabilities, can access the information and services they need. This commitment reflects the FTBs dedication to ensuring that its resources are available to everyone.

The FTB collaborates with other state agencies to provide a unified approach to taxpayer services. As a partner agency of the California Tax Service Center, the FTB contributes to a collaborative environment where taxpayers can access a broad range of information and services related to various taxes and fees. This partnership ensures that taxpayers have a single point of contact for many of their tax-related needs.

In addition to the services provided by the FTB, it's worth noting that other governmental bodies play key roles in financial matters. For instance, the Missouri Department of Revenue manages business tax regulations and collects taxes such as sales and use tax, employer withholding, motor fuel tax, and more. The Comptroller's Office also provides reminders to franchise taxpayers, such as the May 15 due date for franchise tax reports, extension requests, and payments. The Joint Agency Office, which includes the Employment Development Department (EDD), the Board of Equalization, and the Franchise Tax Board, also provides services and support to the public.

Overall, the California Franchise Tax Board (FTB) and its associated services, such as MyFTB, represent a robust framework for managing state taxes. With a focus on accessibility, convenience, and taxpayer support, the FTB strives to simplify the tax process and ensure that taxpayers have the tools and information they need to meet their fiscal obligations.