Are you a household employer struggling with the complexities of payroll and taxes? Managing household employees, from nannies to senior caregivers, doesn't have to be a headache. Poppins Payroll offers a streamlined, affordable solution to make paying your staff legally and effortlessly a reality.

Poppins Payroll steps in to handle the intricate dance of payroll, social security, Medicare, unemployment, and other tax obligations. For just $49 a month, Poppins takes the reins, managing calculations, forms, registrations, and submissions. This is particularly beneficial for those employing nannies, housekeepers, or senior caregivers, making it easier to comply with all legal and financial obligations. The service simplifies the process, ensuring employees are paid correctly and that all necessary taxes are filed accurately and on time.

| Feature | Description | Benefit |

|---|---|---|

| Payroll Processing | Handles all payroll calculations, including gross pay, deductions, and net pay. | Ensures employees are paid accurately and on time. |

| Tax Filing | Calculates, files, and remits federal, state, and local payroll taxes. | Avoids penalties and ensures compliance with tax regulations. |

| Direct Deposit | Provides direct deposit to employee bank accounts. | Offers a convenient and secure way to pay employees. |

| Pay Stubs | Generates and distributes pay stubs to employees. | Provides transparency and documentation for employees. |

| Year-End Forms | Prepares and files W-2 forms and other year-end tax forms. | Simplifies tax season and ensures accurate reporting. |

| Compliance | Ensures compliance with all applicable federal, state, and local labor laws. | Minimizes legal risks associated with employing household staff. |

| Pricing | Offers a flat monthly fee, typically around $49. | Provides predictable and affordable payroll services. |

| Customer Support | Provides customer support to answer questions and resolve issues. | Offers peace of mind and assistance when needed. |

Reference: Poppins Payroll Official Website

The world of household employment often brings with it a series of intricate financial obligations. Nanny taxes, for instance, are not a simple matter. These include federal and state tax responsibilities that families must manage when hiring a household employee, such as a nanny or a caregiver. Poppins Payroll demystifies these complexities, offering a simple, streamlined solution.

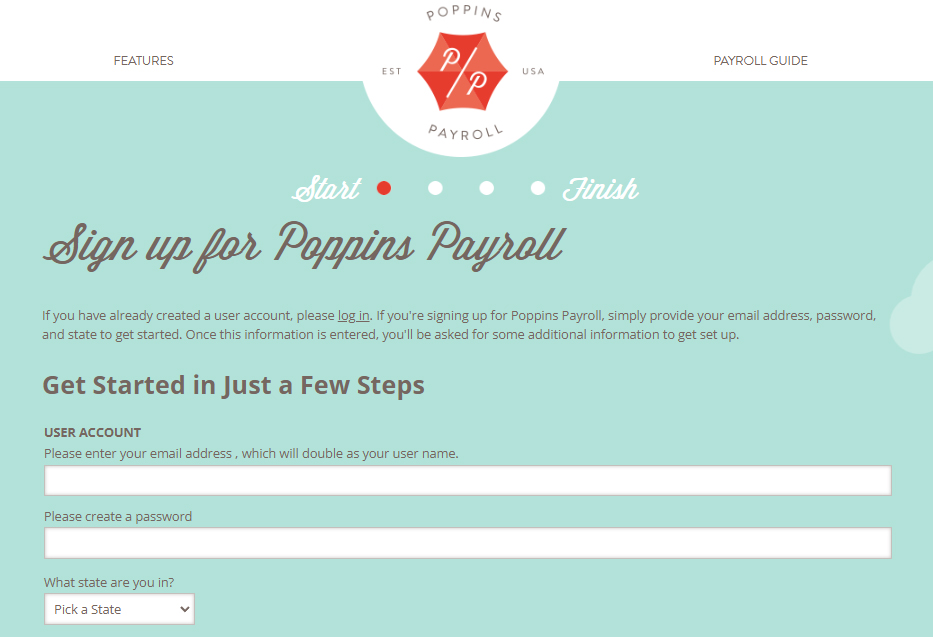

Poppins Payroll positions itself as more than just a service; it's a partner. Its a partner of gusto that simplifies domestic payroll. They handle taxes, compliance, paperwork, and benefits for your nannies, housekeepers, and caregivers. The user experience is designed to be intuitive, allowing users to sign up, access, pay, and file their payroll and tax documents with ease and security via the app. The platform's automatic calculations, direct deposit capabilities, and electronic filing functionalities further streamline the process. This service, specifically designed for household employees, offers basic payroll services and tax filings for a flat monthly fee, presenting itself as sensibly priced and drawing positive reviews for its professionalism and efficiency.

The service is designed to save time and worry, particularly for those new to managing household employees. Many users have shared how daunting the prospect of legally managing an employee can be, especially for short-term needs. The platform is structured to provide flexibility, guidance, and support. By handling the calculations for tax withholdings and generating the required documentation like pay stubs, Poppins Payroll allows families to focus on what truly matters: their family.

The core of Poppins Payroll's appeal lies in its simplicity. The service streamlines the entire process, from depositing payments to employee accounts and remitting payroll taxes to electronically filing tax forms. The flat monthly fee of $49 for one worker encompasses all nanny payroll and tax processes, making it an attractive option for households looking for a cost-effective solution. With features such as automatic calculations, direct deposit, and electronic filing, the platform presents a convenient way to manage household payroll. It caters to nannies, senior caregivers, housekeepers, and other household staff, ensuring that taxes are paid to the correct agencies on time and with accuracy.

One of the critical aspects of Poppins Payroll is its comprehensive nature. By taking care of all aspects of nanny and household payroll and taxes at an affordable price, the platform aims to simplify a traditionally complex area. It allows household employers to focus on their primary responsibilities while ensuring compliance with tax regulations. Its ability to handle the intricate calculations and documentation involved in tax withholdings, coupled with its commitment to accuracy and timeliness, makes it a reliable choice for families.

The service not only simplifies the tax process but also ensures that users can set their own sick leave policies, adding a layer of customization that can meet the unique needs of each family. It addresses key pain points like tax deadlines and rules, paying taxes to the correct agencies accurately and on time.

The customer testimonials speak volumes. Many users appreciate the time saved and the reduction in worry. The platforms reliability in handling payroll, particularly during short-term hiring situations, offers peace of mind. The service is designed to handle payroll, tax, and paystub solutions for nannies and other household help, which has received excellent customer reviews.

Poppins Payroll is often highlighted for its user-friendliness. The ease of use is one of the platform's main selling points. It offers comprehensive payroll services and also ensures adherence to all legal and financial obligations. The service aims to simplify the management of household employees by handling all calculations, filings, and submissions. The platform is designed to provide a seamless experience, enabling users to access, pay, and file payroll and tax documents securely through the app. For those concerned about compliance with tax regulations, this simplifies the process by taking care of calculations, filings, and submissions.

The platform's support system also adds significant value, with options to seek answers, speak with account representatives, and learn more. This commitment to customer service helps to build trust and ensure that users feel supported throughout the process.

In a market where managing household payroll can be overwhelming, Poppins Payroll positions itself as a trusted, easy, and affordable solution. It offers a full range of services, from payroll to taxes, at a single, competitive price. It helps users to run a perfect payroll, making it easier to handle the financial and administrative aspects of employing household staff.

The service further simplifies the process by handling all aspects of nanny and household payroll and taxes at an affordable price. It offers comprehensive solutions to payroll, tax, and paystub management. This streamlined approach allows families to concentrate on their primary responsibilities while Poppins Payroll manages the complex details. This platform stands out for its straightforward, easy-to-use design, making the process accessible to all types of users.