Are you navigating the complexities of California taxes? The California Franchise Tax Board (FTB) is your primary point of contact for understanding and fulfilling your state tax obligations, a crucial step in ensuring financial compliance.

The California Franchise Tax Board (FTB) plays a pivotal role in the state's financial ecosystem. Its primary mission is to ensure the timely and accurate filing of tax returns, coupled with the correct payment of taxes, thereby providing essential funding for services vital to Californians. The FTB's purview encompasses the administration and collection of both state personal income tax and corporate franchise and income tax. It operates under the umbrella of the California Government Operations Agency, emphasizing its integral position within the state's administrative structure.

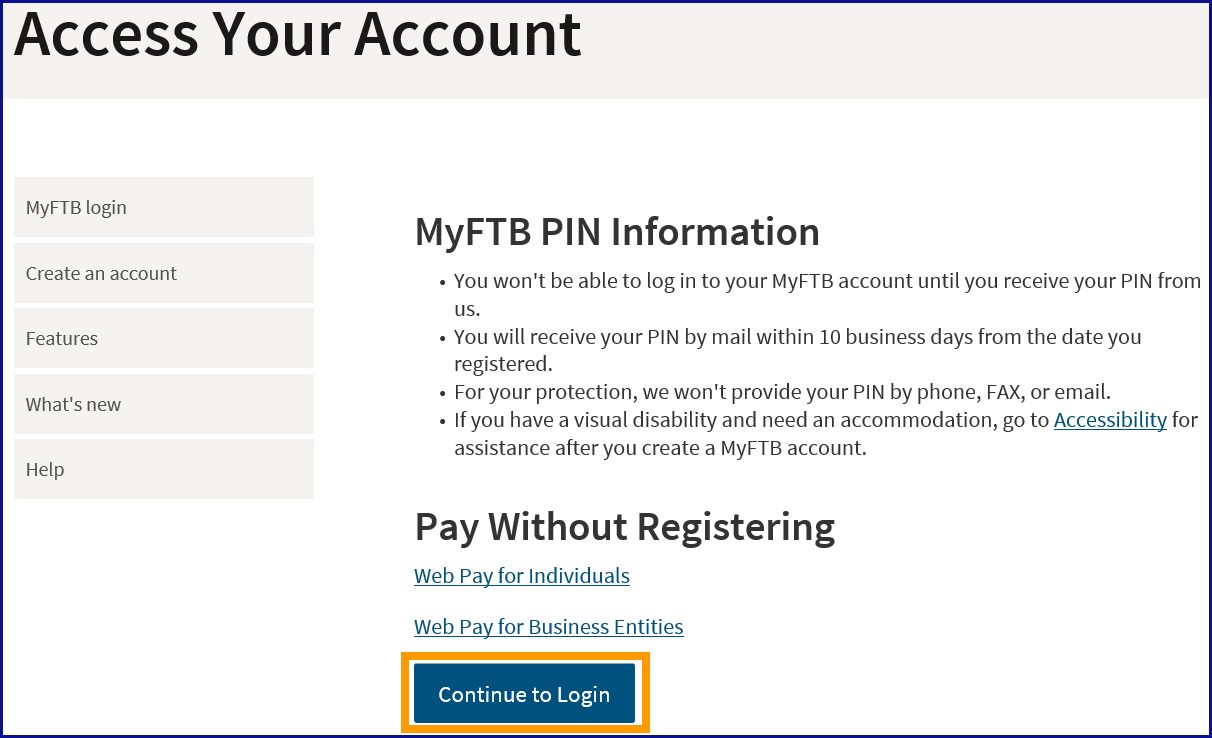

For the convenience of taxpayers, the FTB offers a range of online services. You can file returns, make payments, and check the status of your refunds directly through their online portal. The "myFTB" account provides a centralized hub for accessing these services. Moreover, the FTB website directs users to popular topics and online services, streamlining the process of tax-related activities.

The FTB's commitment to accessibility is noteworthy. The website is designed, developed, and maintained to be accessible as of July 1, 2023, ensuring compliance with California Government Code sections 7405 and 11135. The certification of accessibility is a testament to FTB's dedication to providing inclusive services.

Navigating the FTB's online resources is designed to be straightforward. For example, when using the tax calculator, you'll need to enter your California taxable income, which can be found on line 19 of Form 540 or Form 540NR for the 2024 tax year. However, the calculator does not compute taxes for Form 540 2EZ; in such cases, users are directed to the 540 2EZ tax tables available on the "Tax Calculator, Tables, and Rates" page.

Accessing certain services, such as checking your tax information, requires verification through your Social Security number and last name. It's essential that the information entered precisely matches the records to ensure secure access. Remember that your Social Security number must be entered as nine digits, without spaces or dashes.

The FTB is overseen by a board comprised of key state officials: the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization. These individuals guide the FTB's operations, ensuring it effectively fulfills its duties.

In collaboration with other state agencies, the FTB works as part of a broader tax administration network. Partner agencies include the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service. This collaborative effort enhances the efficiency and effectiveness of tax-related operations.

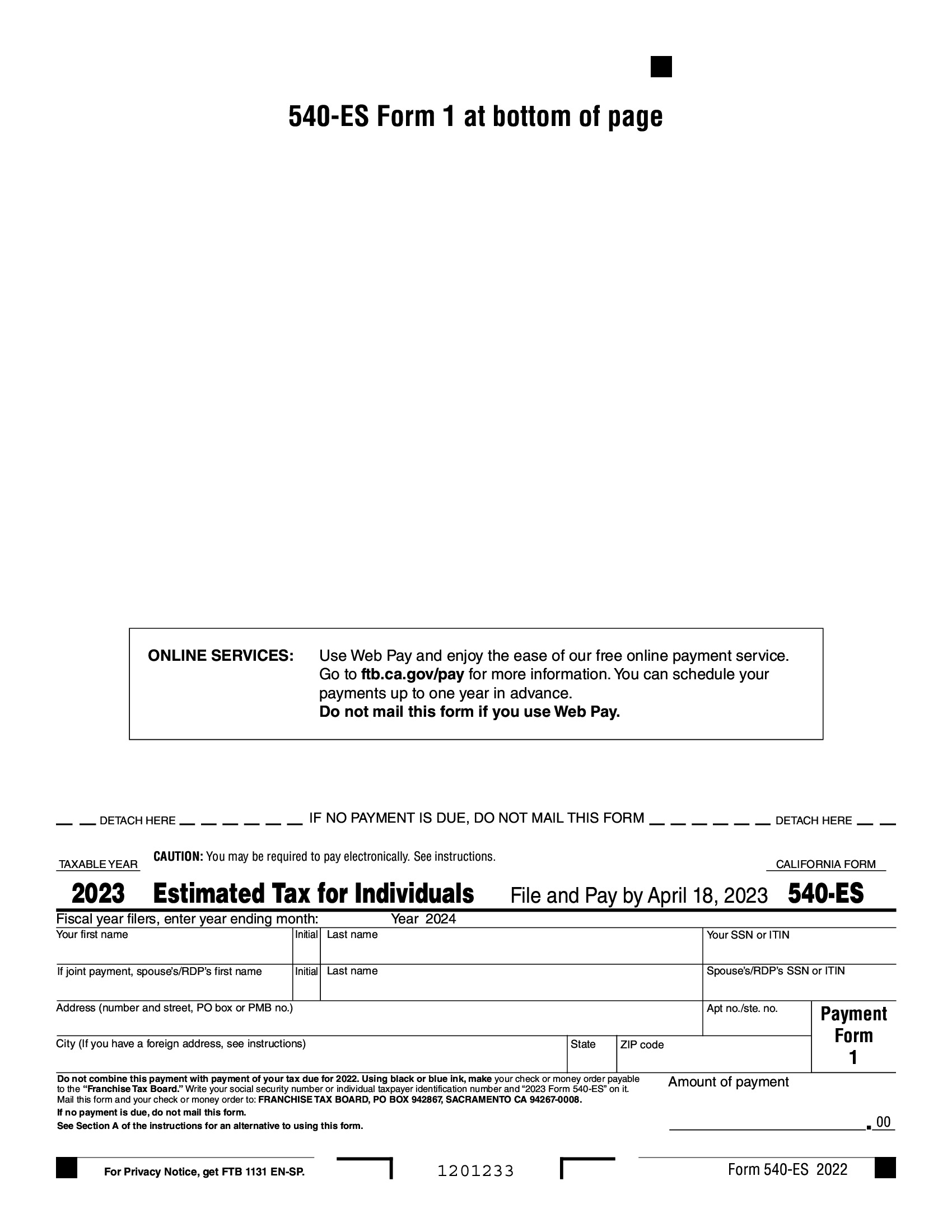

Taxpayers have several payment options. The FTB accepts payments via checking or savings accounts, credit cards, or the establishment of a payment plan. This versatility allows individuals and businesses to manage their tax obligations conveniently.

The website contains information for those who have failed to meet franchise tax filing and/or payment requirements. The resource provides guidance on how to resolve these issues and keep their franchise tax accounts current.

The following table summarizes key information regarding the California Franchise Tax Board (FTB):

| Category | Details |

|---|---|

| Mission | To help taxpayers file tax returns timely, accurately, and pay the correct amount to fund services important to Californians. |

| Responsibilities | Administers and collects state personal income tax and corporate franchise and income tax of California. |

| Parent Agency | California Government Operations Agency |

| Board Composition | California State Controller, Director of the California Department of Finance, and Chair of the California State Board of Equalization. |

| Accessibility Certification | Website certified accessible as of July 1, 2023, in compliance with California Government Code sections 7405 and 11135. |

| Online Services | File a return, make a payment, check your refund, access myFTB account. |

| Payment Options | Checking or savings account, credit card, or payment plan. |

| Partner Agencies | Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, and the Internal Revenue Service. |

| Tax Forms | Form 540, Form 540NR, and related resources. |

| Website Updates | Website last updated 01/15/2025 |

| Contact Information | Department website more contact info description. |

For those needing assistance or more detailed information, the FTB website offers extensive resources, including contact information, frequently asked questions, and detailed guides. This information empowers taxpayers to fulfill their tax obligations efficiently.

It's vital to remember that accurate and timely tax filing is a cornerstone of civic responsibility. By utilizing the resources provided by the California Franchise Tax Board, you can fulfill your tax obligations and contribute to the services that benefit all Californians.

If your entity's annualized total revenue for the 2024 tax year is a significant factor, ensure that you are appropriately following the filing procedures and are aware of how this impacts your franchise tax filing requirements. Remember to accurately input the necessary details when using the FTB's online tools to get the most accurate results.

The FTB also focuses on the digital accessibility of its services. The ongoing commitment to ensure that its website meets the needs of all users is evident. The "accessible technology program" and related initiatives highlight the FTB's effort to provide inclusive resources. As of July 1, 2023, its website is fully accessible and compliant with California Government Code Sections 7405 and 11135, guaranteeing that people with disabilities can access all available resources and services. This commitment underlines the FTB's dedication to making tax-related information and processes open to everyone, thereby promoting fairness and facilitating broad participation. Taxpayers should utilize the diverse digital options offered, such as "myFTB" accounts and online services, to handle their tax needs conveniently and safely.

In conclusion, the California Franchise Tax Board plays a crucial role in the financial structure of California by offering easy access to a wide variety of services. The FTB consistently updates its platform to meet the evolving demands of taxpayers. You can find online services, ensure your tax filings are correct, and meet all your obligations. The FTB's commitment to accessibility, including the certification of its website, emphasizes its dedication to equity and compliance with regulations. By being proactive and using the resources provided by the FTB, taxpayers can actively engage in the tax process, promoting financial integrity and assisting in the funding of essential services for all Californians.