What if there was a way to quickly assess a company's financial health, cutting through the noise of complex accounting practices? EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, offers a powerful lens through which to view a company's core operating performance, providing valuable insights for investors and analysts.

EBITDA is a financial metric that has become increasingly popular in the world of finance. It serves as a crucial tool for evaluating a company's operational profitability by excluding certain non-cash expenses. Understanding EBITDA's role, its calculation, and its limitations is vital for anyone seeking to make informed financial decisions.

Understanding EBITDA

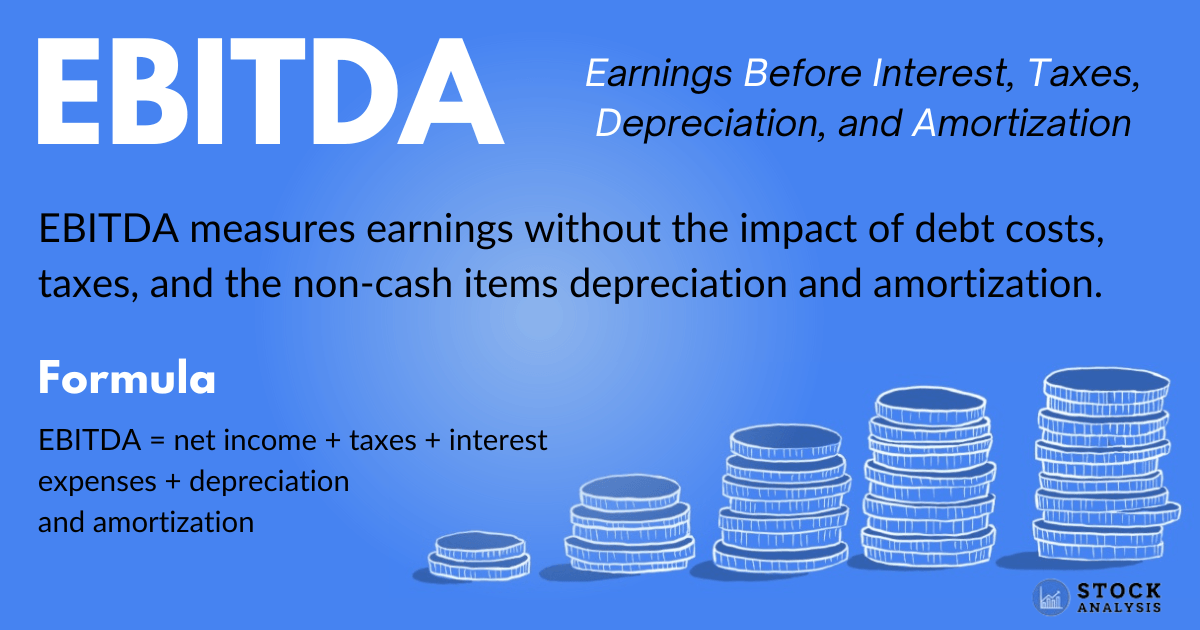

At its core, EBITDA is a measure of a company's earnings before the deduction of interest, taxes, depreciation, and amortization. This provides a clearer picture of a company's ability to generate profits from its core business operations, by removing the impact of financing decisions, tax regimes, and accounting methodologies related to asset values.

The formula for calculating EBITDA is straightforward:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Let's break down each component and understand its significance.

- Net Income: This is the company's profit after all expenses, including interest, taxes, depreciation, and amortization, have been deducted.

- Interest: This represents the cost of borrowing money. Adding it back to net income allows for a comparison of companies with different capital structures.

- Taxes: Taxes are a function of where the company is based and how that government taxes business, and vary. Adding back taxes gives a good look at operating performance before tax obligations.

- Depreciation and Amortization: These are non-cash expenses that reflect the decline in value of a company's assets over time. Adding them back provides a clearer picture of the company's true cash-generating capabilities.

Why is EBITDA Useful?

EBITDA provides a valuable perspective for several reasons:

- Focus on Core Operations: By excluding financing, tax, and accounting expenses, EBITDA highlights a company's ability to generate profits from its primary business activities.

- Comparative Analysis: EBITDA allows for easier comparison of companies within the same industry, even if they have different capital structures, tax rates, or accounting practices.

- Valuation Tool: EBITDA is frequently used in valuation, particularly in the context of leveraged buyouts and mergers and acquisitions. It serves as a key input in calculating enterprise value multiples.

- Cash Flow Proxy: EBITDA can serve as a proxy for a company's operating cash flow, though it is not a perfect measure. It is useful in assessing a company's ability to cover its operating expenses.

EBITDA also speaks to a company's operational profitability by excluding depreciation and amortization expenses. This approach allows investors and analysts to focus on a company's ability to generate profit from its ongoing operations, effectively stripping away the impact of past investment decisions and accounting treatments.

Limitations and Criticisms of EBITDA

Despite its utility, EBITDA is not without its drawbacks. It's crucial to understand its limitations to avoid misinterpreting its results.

- Ignores Capital Expenditures: EBITDA does not account for capital expenditures (CAPEX), which are essential for maintaining and growing a business. A company with high EBITDA but insufficient CAPEX may face long-term challenges.

- Non-Cash Expenses: While depreciation and amortization are excluded, they are still real expenses that reflect the wear and tear of assets. Ignoring them can provide an inflated view of a company's profitability.

- Financial Engineering: Companies can sometimes manipulate their EBITDA figures to present a more favorable picture. This can involve aggressive accounting practices or one-time gains that inflate the metric.

- Not a Substitute for Cash Flow: Although EBITDA can be used as a proxy, it does not equal cash flow. It doesn't account for changes in working capital or capital expenditures.

EBITDA is not widely used by analysts because it is more conservative than ebitda, which also adds back taxes.

Ultimately, EBITDA should be used in conjunction with other financial metrics and ratios for a complete understanding of a company's financial performance.

Real World Applications and Examples

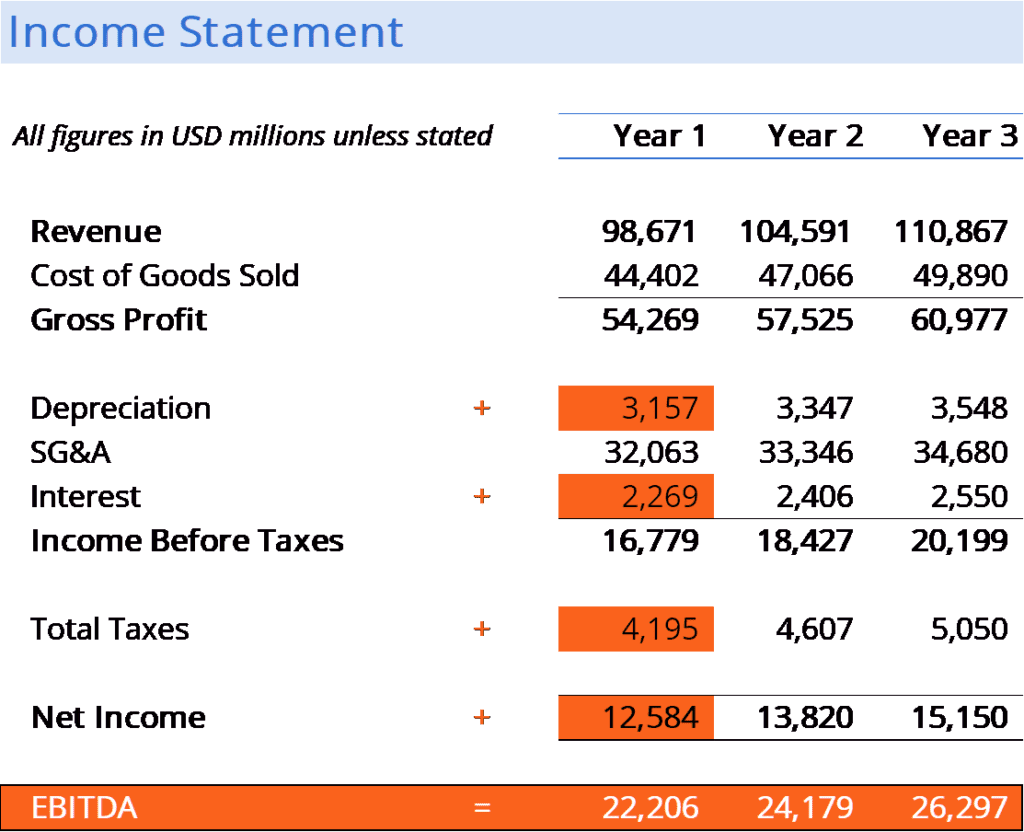

To illustrate the practical application of EBITDA, consider a hypothetical example using Company XYZ's income statement.

Hypothetical Income Statement for Company XYZ

| Item | Amount ($) |

|---|---|

| Net Income | 500,000 |

| Interest Expense | 100,000 |

| Tax Expense | 150,000 |

| Depreciation Expense | 200,000 |

| Amortization Expense | 50,000 |

| EBITDA | 1,000,000 |

Calculation:

EBITDA = $500,000 (Net Income) + $100,000 (Interest) + $150,000 (Taxes) + $200,000 (Depreciation) + $50,000 (Amortization) = $1,000,000

In this scenario, Company XYZ has an EBITDA of $1,000,000. This indicates the company's strong ability to generate profits from its operations, irrespective of financing, tax, or depreciation factors.

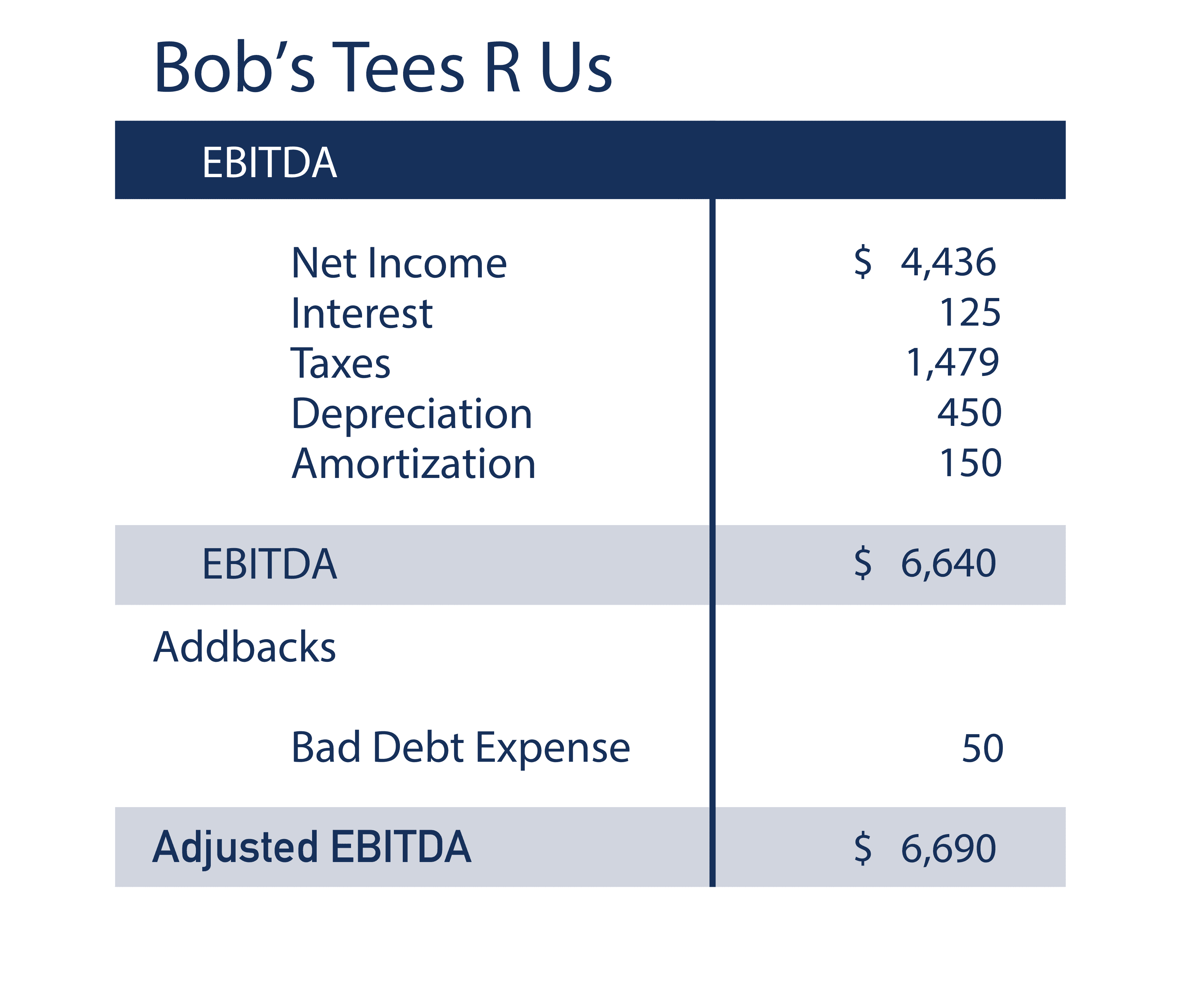

Adjusted EBITDA

Sometimes, analysts and investors will use "adjusted EBITDA". This goes beyond the standard calculation by further adjusting for non-recurring or unusual items. These adjustments may include:

- One-time gains or losses: These are items that are not part of the company's regular operations.

- Restructuring costs: Costs associated with organizational changes.

- Legal settlements: Significant legal expenses that are unlikely to occur regularly.

The goal of adjusted EBITDA is to provide a more realistic picture of a company's underlying operating performance by eliminating items that skew the results.

The core advantage of adjusted EBITDA is that it can help to smooth out the impact of anomalies and provide a clearer picture of a business's underlying earning power.

EBIDA vs. EBITDA

While both terms are related, there's a significant difference between EBITDA and EBIDA. EBIDA (Earnings Before Interest, Depreciation, and Amortization) adds back interest, depreciation, and amortization expenses to net income, but does not add back taxes. Therefore, EBIDA is often considered a more conservative measure than EBITDA, because it does take tax expenses into account. This distinction is vital when evaluating a company's financial performance.

EBITDA in Practice

EBITDA is commonly used in valuation. One primary application is calculating the "enterprise value to EBITDA" multiple. This multiple helps in determining the value of a business relative to its cash-generating capabilities. It's used in comparable company analysis and precedent transactions, offering a quick way to assess whether a company is overvalued or undervalued in comparison to its peers.

The metric is also used in financial modeling and forecasting. By projecting a company's EBITDA over time, analysts can estimate future cash flows and assess its financial health. Lenders frequently use EBITDA to assess a company's ability to repay debt.

Additional Insights and Considerations

When assessing EBITDA, the following points should be kept in mind:

- Industry-Specific Variations: EBITDA's significance can vary by industry. For capital-intensive industries, depreciation will be significant, whereas, for services industries, it may be less so.

- Trends over Time: Analyze EBITDA over several periods to identify trends. A consistent increase in EBITDA, or even a stable EBITDA, can indicate robust business performance, while a decline raises a red flag.

- Management's Role: Review management's statements and discussions about EBITDA. Consider the context in which the figure is used.

- Context is King: Always combine EBITDA with other financial metrics, such as revenue growth, net income, and free cash flow.

- Due Diligence: When assessing a business, conduct thorough due diligence. Investigate the company's accounting practices and consider the nature of the items excluded from the EBITDA calculation.

EBITDA in Different Languages

The concept of EBITDA, despite its English-language origins, has been adapted and used globally. The translations often reflect the same core principles, focusing on earnings before interest, taxes, depreciation, and amortization, but the terminology can vary:

- French: L'EBITDA (earnings before interest, taxes, depreciation and amortization) is a management balance used in American accounting to assess the profitability of the company's operating cycle, regardless of its investment or financing policy.

- German: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) - a term that is well-known in Germany to assess the operating income of a company.

- Spanish: EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is widely used as a key metric in financial analysis.

- Serbian: EBITDA (Earnings before interest, taxes, depreciation and amortization) is translated as profit before interest, taxes, and amortization is subtracted.

- Polish: EBITDA, which stands for "earnings before interest, taxes, depreciation, and amortization" is a financial indicator that reflects a company's operating profit before deduction of a number of key financial factors.

Conclusion

EBITDA is a critical tool for understanding a company's operational profitability. By stripping away the effects of financing, taxation, and accounting methods, it offers a clear view of a company's core earnings power. However, it's important to be aware of its limitations and always view it in the context of other financial metrics. By understanding both the strengths and weaknesses of EBITDA, investors and analysts can make better-informed decisions in the complex world of finance.